- Stocks in Play

- Posts

- The Week Ahead : July 21st - 25th 2025

The Week Ahead : July 21st - 25th 2025

Highlights: ENPH, TSLA, GOOG, DHR Earnings, Small Caps Flying!

The Week Ahead : July 21st - 25th 2025

Highlights: ENPH, TSLA, GOOG, DHR Earnings, Small Caps Flying!

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

I use Benzinga Pro for 90% of my research each day. I have recently subscribed to a LIFETIME subscription. This is available for a one off price of $1650. This is incredible value. If this is something you’d be interested in then shoot me an email ([email protected]) and I’ll put you in touch with the Rep to receive the agreed price. I couldn’t recommend it highly enough.

The Week Ahead

Solid earnings week for Market Movers this week. A lot of important names for the market are reporting. Many of them won’t interest us for trading but will be important for those monitoring tariff repercussions (or lack of). The obvious ones that could be interesting are DHR, slower mover but beaten down. ENPH, interesting for solar names and severely beaten down. TSLA & GOOG are the obvious big names. TSLA is interesting because the narrative is quite negative, and expectations are also negative. GOOG is the same, and I think they will surprise to the positive. TSLA not so much but never bet against Musk to pull a pump out of the bag! CMG also interesting. MBLY on Thursday also an AV Theme stock.

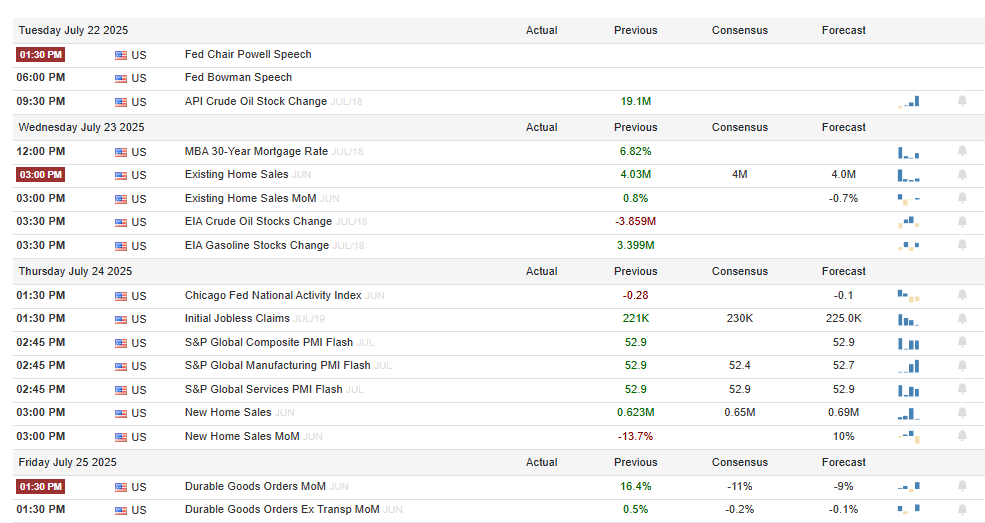

In terms of macro we have Flash PMIs on Thursday. We will likely continue to hear the Tariff narrative on repeat this week. I’m not really concentrating on any of this unless I see VIX move and the market turn. Otherwise it’s just continue on watching the individual names and themes. Small caps and story themes have been flying but expect to seem some bigger names get tradable moves in the next few weeks.

Our main themes continue to be: Drones, Quantum, Rare Earths, AVs & Crypto (Treasuries/Stablecoins). A lot of speculation here. IPO market seems to be opening up and I’m reading a lot of ‘‘The market is going to crash, this is dumber than 2021’’. I can tell you it is absolutely not dumber than 2021, YET. It looks like it’ll get there but there is plenty of road to go in my opinion.

Individual stock news from the weekend. NWS being sued for $10b by Trump could be a solid negative catalyst for a potential short on Monday will be monitoring this pre market. XYZ added to the SP500 After Hours on Friday. I don’t like these index add catalysts much but it’s worth noting the near perfect base range that the stock has been in since 2022. A decent earnings catalyst (Aug 7th) could get it going finally.

Earnings Highlights

Monday :

(Before Market Open) - CLF, VZ

(After Market Close) - DHR, LMT, NOC

Tuesday:

(After Market Close) - ENPH, ISRG, TXN

Wednesday:

(Before Market Open) - TMO, FI, GEV

(After Market Close) - QS, TSLA, GOOG, CMG, IBM

Thursday:

(Before Market Open) - DOW, MBLY

(After Market Close) - INTC, DECK, COUR

Friday:

(Before Market Open) - CNC, BAH, CHTR

Next weeks full earnings watchlist on TradingView can be accessed here.

Macro Events (Eastern Time)

Delayed Reaction Watchlists:

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

Have a Great Week!

Born Investor

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk (Paid) - Email me for Lifetime Subscription for $1650

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply