- Stocks in Play

- Posts

- The Week Ahead : July 14th - 18th 2025

The Week Ahead : July 14th - 18th 2025

Highlights: Earnings Season is Back!

The Week Ahead : July 14th - 18th 2025

Highlights: Earnings Season is Back!

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

I use Benzinga Pro for 90% of my research each day. I have recently subscribed to a LIFETIME subscription. This is available for a one off price of $1650. This is incredible value. If this is something you’d be interested in then shoot me an email ([email protected]) and I’ll put you in touch with the Rep to receive the agreed price. I couldn’t recommend it highly enough.

The Week Ahead

The macro narrative is still on Tariff central. The threats seem to be ratchetting up from the US side. We are all still walking the TACO (Trump Always Chickens Out) line. Which has worked really well up to know and may continue to work. Worth remembering that every trend must end though and this one is getting long in the tooth.

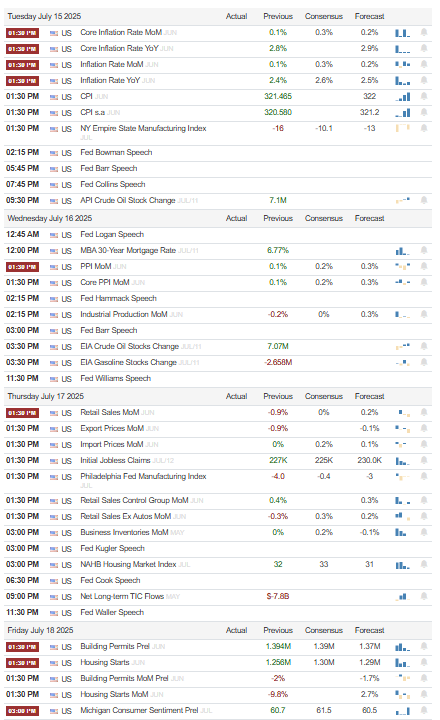

Key Economic events this week are the US CPI on Tuesday morning and Michigan Sentiment Report on Friday morning.

In terms of individual stocks we have earnings season kicking off with the banks on Tuesday, highlight of the week likely being NFLX on Thursday evening. This weeks earnings may not result in a lot of tradable Stocks in Play but usually sets the tone and narrative for the rest of the season.

Crypto remains in focus with strong moves over the weekend, Drone stocks are also in theme from last week. Markets have been choppy. Small caps have worked best for my style recently but I am looking for some strong earnings names in the next few weeks.

Earnings Highlights

Monday :

(Before Market Open) - FAST

Tuesday:

(Before Market Open) - JPM, WFC, C

Wednesday:

(Before Market Open) - BAC, MS, GS, ASML

(After Market Close) - UAL, KMI, AA

Thursday:

(Before Market Open) - TSM, GE

(After Market Close) - NFLX, IBKR

Next weeks full earnings watchlist on TradingView can be accessed here.

Macro Events (Eastern Time)

Delayed Reaction Watchlists:

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

Have a Great Week!

Born Investor

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk (Paid) - Email me for Lifetime Subscription for $1650

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply