- Stocks in Play

- Posts

- The Week Ahead : August 25th - 29th 2025

The Week Ahead : August 25th - 29th 2025

Highlights: Big Tech Earnings, Steady start to Monday Morning

The Week Ahead : August 25th - 29nd 2025

Highlights: Big Tech Earnings, Steady start to Monday Morning

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

I use Benzinga Pro for 90% of my research each day. I have recently subscribed to a LIFETIME subscription. This is available for a one off price of $1650. This is incredible value. If this is something you’d be interested in then shoot me an email ([email protected]) and I’ll put you in touch with the Rep to receive the agreed price. I couldn’t recommend it highly enough.

Monday Stocks in Play

I don’t see anything A+ this morning (maybe RR). There are several Crypto Treasury stocks trying to move pre market ASST, ETHZ, STSS. Of any of them ETHZ probably has the best chance of making a mean reversion move. Crypto is very weak today though so I have my doubts. HCWB looks like the Biotech mover of the day. It is a nanocap though, so will be highly volatile and likely raise intraday. I like delayed reaction setups in INTC and MSOS (TLRY Upgrade).

RR has an interesting catalyst - Entered into a Master Services agreement with one of the largest retailers in the world. Decent theme - Robotics. Done by way of SEC filing vs. Puff piece. (There is an NDA). High short interest. Really nice Daily Chart.

X-Ray RR: Industry Group: Specialty Industrial Machinery, Market Cap: 313.27M, Float: 103.03M Short Interest 16.21%, Days to Cover: 1.60, Exchange: NASDAQ

Overall though I am calm coming into Monday, no intention to go wild adding risk. Concentrating on some delayed reactions mainly where I’d like to get back into some themes like Drones and Cannabis where I see potential for sustained moves.

The Week Ahead

Big finish to the week last week. Let’s see do we have a Monday fade. We conclude earnings season this week with some major Tech names and China Stocks.

NVDA, CRWD, SNOW are the main names but other important AI earnings include DELL, MRVL, ESTC. We also have a lot of China reporting PDD, BABA, BZUN, TIGR and more plus some momo names like BULL, AFRM etc. Enough to keep us busy.

There are some nice charts out there and earnings are very manageable this week for sifting through. No excuse to miss a mover.

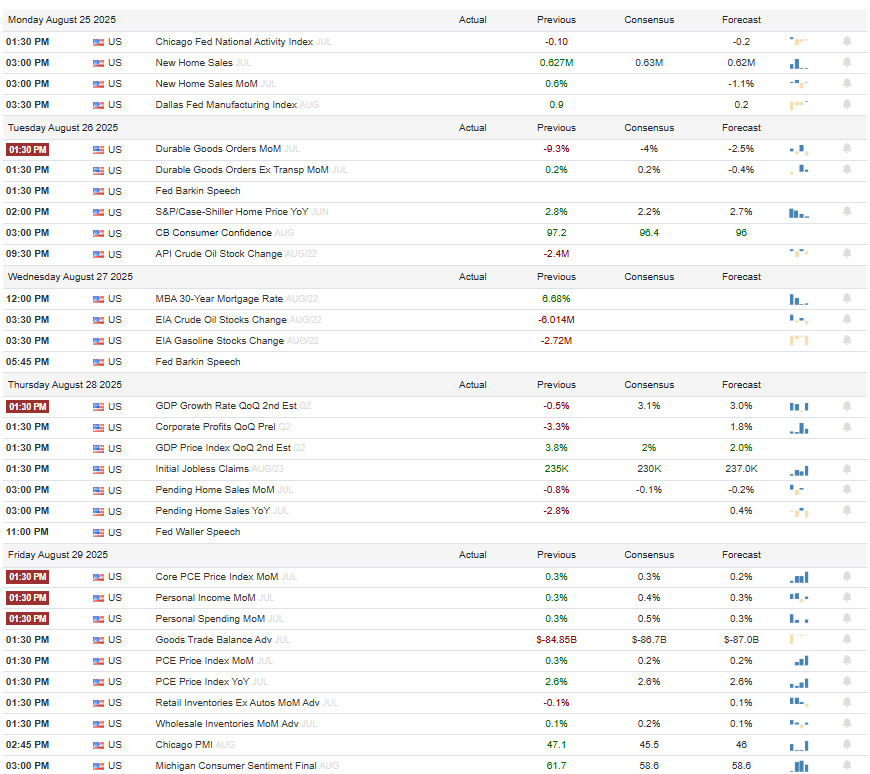

Economic numbers this week. Home Prices on Tuesday at 9:00am EST, US PCE Friday Morning @ 08:30am EST. There are also several treasury auctions this week that will be closely watched (Tues, Weds, Thurs).

Earnings Highlights

Monday :

(Before Market Open) - PDD

(After Market Close) - SMTC

Tuesday:

(Before Market Open) - BEKE, EH,

(After Market Close) - OKTA, MDB, BOX, NCNO

Wednesday:

(Before Market Open) - TIGR, KSS, ANF, WSM

(After Market Close) - NVDA, SNOW, CRWD, TCOM, HPQ, URBN, FIVE, VEEV

Thursday:

(Before Market Open) - SBSW, DG, BURL

(After Market Close) - IREN, MRVL, BULL, AFRM, S, DELL, ESTC, ADSK, AMBA, ULTA

Friday:

(Before Market Open) - BABA

Next weeks full earnings watchlist on TradingView can be accessed here.

Macro Events (Eastern Time)

Delayed Reaction Watchlists:

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

Have a Great Week!

Born Investor

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk (Paid) - Email me for Lifetime Subscription for $1650

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply