- Stocks in Play

- Posts

- The Week Ahead : 5th - 9th January 2026

The Week Ahead : 5th - 9th January 2026

Highlights: And we're back!

The Week Ahead : 5th - 9th January 2026

Highlights: And we’re Back!

Situational Awareness

Follow through on Positions - Yes (selective themes), Lot’s of Breakouts Friday

Market Above Moving Averages - Yes

Market Monitor - Showing Rangebound Conditions

Personal Sentiment: Certain themes showing a lot of strength. I still think we see significant choppiness for the next few weeks and potential for volatility with global tensions. Select themes working, lot’s of breakouts on Friday which remain to be seen if they have follow through. Defense Theme also likely to continue to be strong - Drones, A&D etc.

Trading as normal at the moment, not aggressive in size. Cautious for volatility shocks due to Macro issues like Venezuela etc. but just going to let the market tell me rather than worrying about it too much. As always the VIX is a guide for me as an alarm.

Today’s Picks

I was hoping to return with my first newsletter of the year with a banger pick but I’m not seeing anything amazing today. I know the Venezuela catalyst is probably obvious. Both XOM and CVX have good charts in long consolidations but they’re quite slow movers. If I’m expecting the smaller caps to run I am probably not wanting to tie up a lot of capital with big size in slow moving Oil Stocks.

SMXT: SolarMax Technology announced two EPC (engineering, procurement, and construction) contracts for utility-scale battery energy storage system (BESS) projects in Puerto Rico. The company will build 400 MWh of combined storage capacity for Yabucoa BESS LLC and Naguabo BESS LLC, with total expected revenues of $158.3 million. SolarMax is also purchasing a 9% equity stake in each project entity.

Microcap shitco so beware. Strong move pre market with volume. Not for fainted hearted and likely a one day wonder if it can go in market hours.

X-Ray SMXT: Industry Group: Solar, Market Cap: 47.79M, Float: 39.28M Short Interest 0.93%, Days to Cover: 2.46, Exchange: NASDAQ

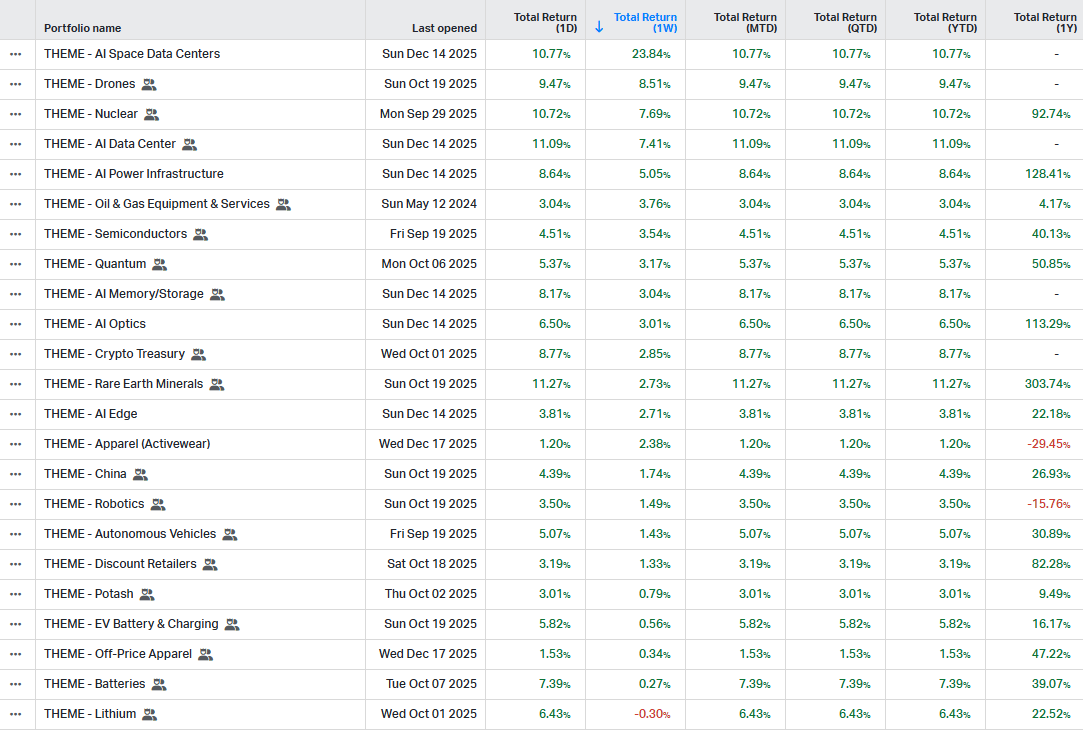

Theme Watch

Difficult to take a lot from the final week of December/first day of January but speculative themes were very strong. Space Stocks, Drones, Nuclear and Data Center stocks were very strong. Overall we want to see these speculative ideas setting up and being strong. I still think we need some more time for the real quality charts to develop so I expect some fails to occur to stop out weaker hands.

Earnings Highlights

BLACK - Chart

GOLD - Market Importance

Monday :

(Before Market Open) -

(After Market Close) -

Tuesday:

(Before Market Open) -

(After Market Close) -

Wednesday :

(Before Market Open) -

(After Market Close) - APLD, STZ, RELL

Thursday :

(Before Market Open) - AYI, CMC

(After Market Close) - GBX

Friday:

(Before Market Open) -

Biotechs with Potential Catalysts -

Next weeks full earnings watchlist on TradingView can be accessed here.

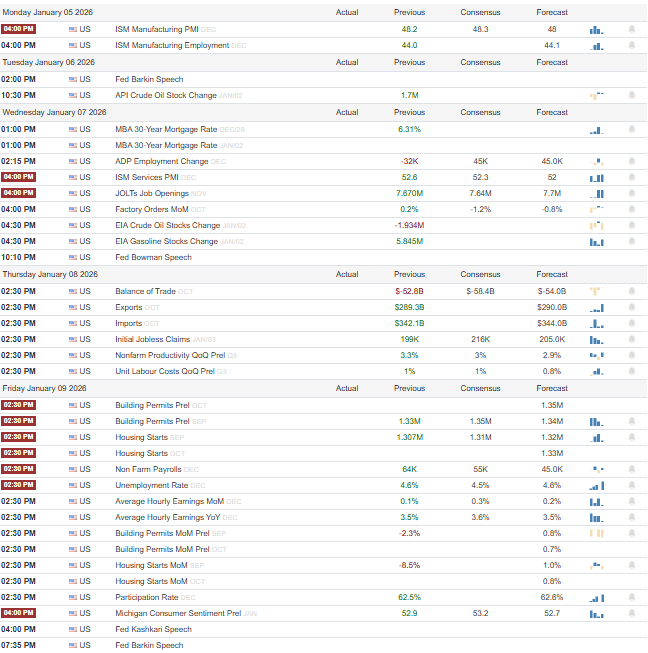

Macro Events (Eastern Time)

Delayed Reaction Watchlist:

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

Have a Great Week!

Born Investor

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply