- Stocks in Play

- Posts

- The Week Ahead : 3rd - 7th November 2025

The Week Ahead : 3rd - 7th November 2025

Highlights: Market Moving Earnings Week

The Week Ahead : 3rd - 7th November 2025

Highlights: Market Moving Earnings Week

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

The Week Ahead

This is another huge week of earnings. There are around 1300 companies reporting this week. There are plenty that could potentially be market movers. PLTR Monday evening, SHOP, UBER Tuesday Morning, AMD, SMCI Tuesday evening, ARM, QCOM Wednesday evening and ABNB Thursday after the close. CEG Friday morning.

On the macro front we may see Government shutdown end this week. This could be a sell the news event. Monday we have Manufacturing ISM at 10am EST, Wednesday Jobs Report @ 8:15am EST, Services ISM at 10am EST and Michigan Sentiment report Friday at 10am EST.

New month but same old market. I am finding lot’s of potential but I think we’re going to have chop and volatile days for the next while. I’m cautious on any remotely extended setups. My holdings have naturally moved into larger cap names in the last week or so. I’m trying not to have any bias and just follow what is working now.

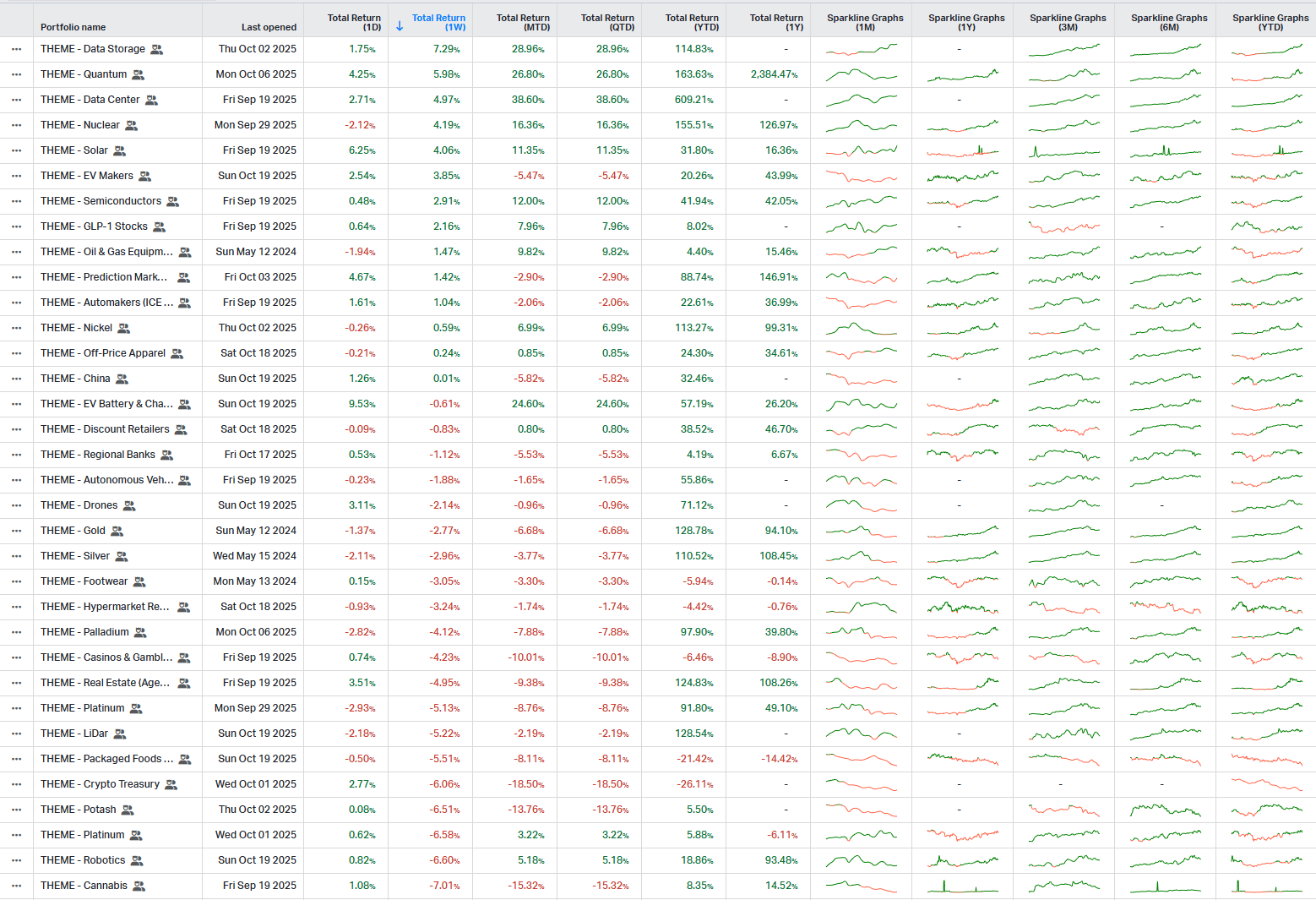

Theme Watch

EV & Battery Chargers had noticeable strength late in the week. A lot of these names are reporting in the coming week. They’re certainly worth monitoring if we get a strong report on one or else a catalyst that ignites them. Oil and Gas continues to improve. We’ve had some stocks run like PUMP. GLP-1 has also seen a nice improvement. Generally though I don’t see a new theme kicking in just yet. I need to add some Medtech/Healthcare and Biotech lists as I’m seeing these work and a lot of earnings setups on them. They’re difficult to track though because they’re quite Binary but there is definitely money pouring in.

Earnings Highlights

Here is a filtered list of stocks that I think could potentially be tradable if their earnings are strong - Trading View Earnings Highlights. This is a broad stroke list of 200 names. These weeks are difficult to narrow down too much but it helps a lot to loosely filter at the weekend. Seeing a lot of Biotech/Healthcare related names that have potential. The list is too big this week to write in the newsletter.

Next weeks full earnings watchlist on TradingView can be accessed here.

Macro Events (Eastern Time)

Delayed Reaction Watchlists:

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

Have a Great Week!

Born Investor

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply