- Stocks in Play

- Posts

- The Week Ahead : 2nd - 6th February 2026

The Week Ahead : 2nd - 6th February 2026

Highlights: Markets in Turmoil

The Week Ahead : 2nd - 6th February 2026

Highlights: Markets in Turmoil

Sources & Services I Use in my Trading:

Finviz - Scanning, Short Interest, Float, Fundamentals

Tradingview - Charting & Scanning

BiopharmaIQ - FDA Calendars & Upcoming Biotech Catalysts

Koyfin - Fundamental Data

Tradersync - Trade Journal

Week Overview

Market Setup: Market is looking weak. We closed below the 10/20 EMA. Still sitting above the 50MA but lots of leaders truly breaking down. Silver and Gold crushed on Friday and Crypto new leg down over the weekend. Overall the setup isn’t good. Market Monitor has flipped out of Healthy Market. Nowhere near any sort of Oversold conditions if we do accelerate. Monitoring VIX which has been strong all week.

Key Themes: Oil and Gas Emerging this week. Monitoring for increase in selling pressure for market.

Leaders & Crypto Breaking Down - PLTR etc.

Oil and Gas Emerging Breakout

Silver & Gold likely to see continued volatility.

Focus Areas: Earnings Catalysts look like the best opportunities. There are some promising charts which I’ve highlighted below. Cautious into the week. Less Trades, Conservative on size and profit taking.

Calendar Notes: Regular Macro events. Nothing major.

Macro Events (Eastern Time)

Monday:

10:00 AM - ISM Manufacturing PMI JAN (Consensus: 48.2)

Tuesday:

10:00 AM - JOLTs Job Openings DEC (Consensus: 7.0M)

Wednesday:

10:00 AM - ISM Services PMI JAN (Consensus: 54.3)

Thursday:

No major events

Friday:

08:30 AM - Non Farm Payrolls JAN (Consensus: 40.0K)

08:30 AM - Unemployment Rate JAN (Consensus: 4.5%)

10:00 AM - Michigan Consumer Sentiment Preliminary FEB

Earnings Highlights

Format:

BOLD = Market importance (market-moving names)

REGULAR = Chart setup (tradable technical setup)

Monday Before Open: DIS, TSN, TWST

Monday After Hours: PLTR, SPG, RMBS

Tuesday Before Open: MRK, TDG, MPC, PFE

Tuesday After Hours: AMD, ENPH, LITE, AMGN, LUMN, CRUS, EMR, APPS, CBT, SIMO, INNV

Wednesday Before Open: LLY, KMT, NVO, UBER

Wednesday After Hours: GOOG, ARM, TTMI, ALGT, CRNC, DGII, EZPW, MOD, SITM, ASGN, BKH, KE, PAHC, PTEN, QGEN

Thursday Before Open: BTU, CAH, HSY, IDCC, GPRE, HII, LODT, MTSI, MSGS, OESX, OMCL, PBH, SPB, XPO

Thursday After Hours: AMZN, IREN, BE, HCHP, ARWR, BARK, MITK, FLS, KN, SYNA

Friday Before Open: BIIB, NVT

Full Earnings Watchlist: TradingView Link

Biotech Catalysts

Chart Assessment: I see no stand out charts in Biotech that are expecting catalysts. Here is my full Q1 Catalyst Watchlist

Full Q1 Biotech Watchlist: TradingView Link

Note: Never front-run biotech catalysts. Wait for the catalyst to hit, then assess if the reaction is tradable. Dates are estimates and can shift.

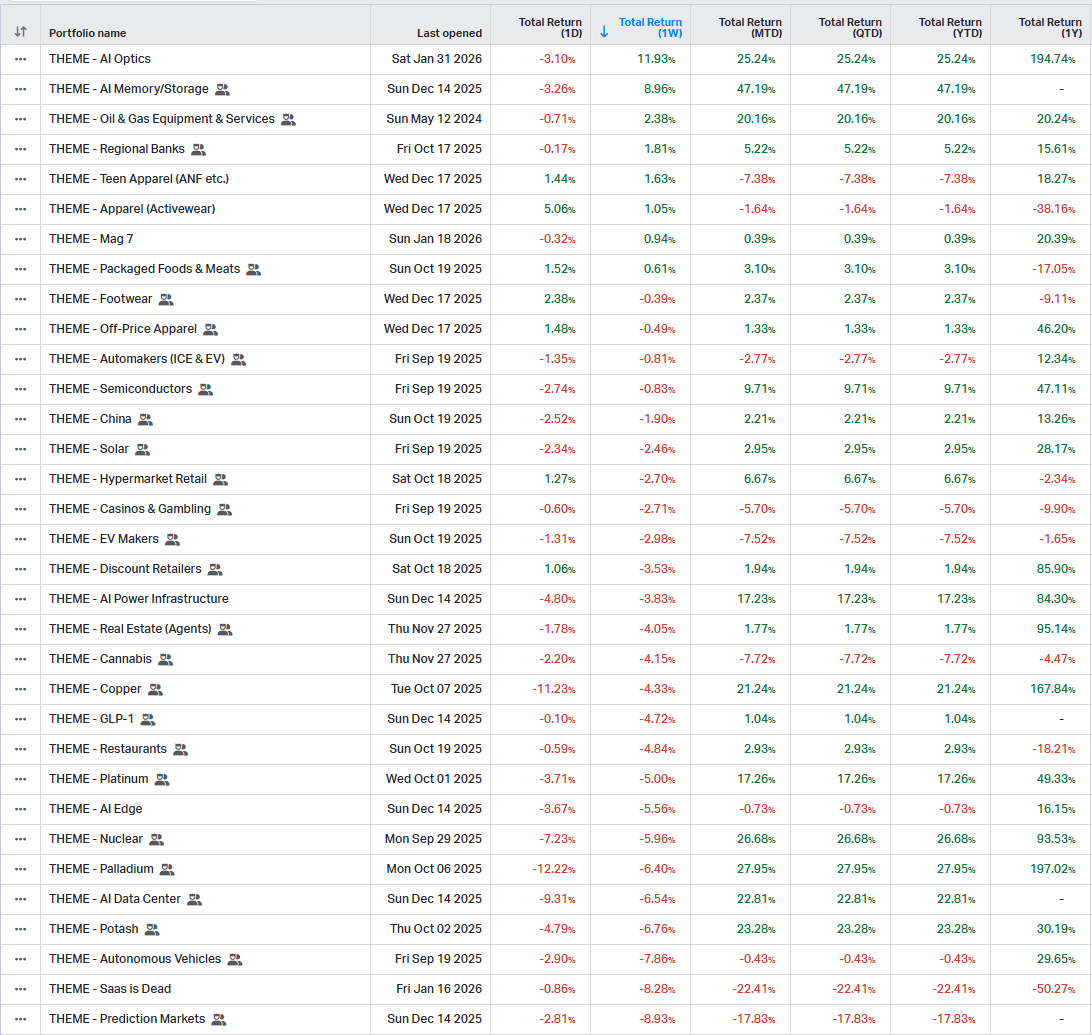

Theme Watch

Sector Strength: This week there was clearly strength in some of the AI Infra areas notably Optics (AAOI etc.) and Memory (SNDK, MU etc.). These are all stretched though. Oil and Gas broke out, regional banks also. Not the type of areas we’re used to looking at.

Emerging Themes:

Oil and Gas: The big names breaking out this week. This is a vast sector that did well in the 2022 Bear Market. It is worth putting some work into this area this week. I will be adding some sub sectors to my THEME lists.

Delayed Reaction Watchlist:

Have a Great Week!

Born Investor

Like what you're reading? Support the analysis via ☕ Ko-Fi

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply