- Stocks in Play

- Posts

- The Week Ahead : 27th - 31st October 2025

The Week Ahead : 27th - 31st October 2025

Highlights: Halloween Earnings Bonanza, META, MSFT, Fed Decision

The Week Ahead : 27th - 31st October 2025

Highlights: Earnings Season Kicks Off!

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

The Week Ahead

Big gap up on the Futures tonight. I guess on the positive headlines from China trade talks but who knows. It may be red by the open tomorrow! The focus for me is on the earnings this week. We have over 750 companies reporting with many of the big market movers reporting too and for the first time in a while I’m seeing tradable setups in them if the earnings come through like in META, MSFT. While GOOG seems to have already left the starting gate.

There are WAY too many names to watch this week. This week and next week can be a trudge but it’s worth it to find that exciting big winner. I’m seeing setups in Industrials and Utilities. Slower movers but I’m also liking the look of things like NET, TDOC, ILMN. I would say that right now there is no individual chart that I’m thinking Wow but lots of potential. I’ve narrowed down the charts below and will loosely watch these. This weekend work familiarizes me with the week ahead and makes me more efficient during the week.

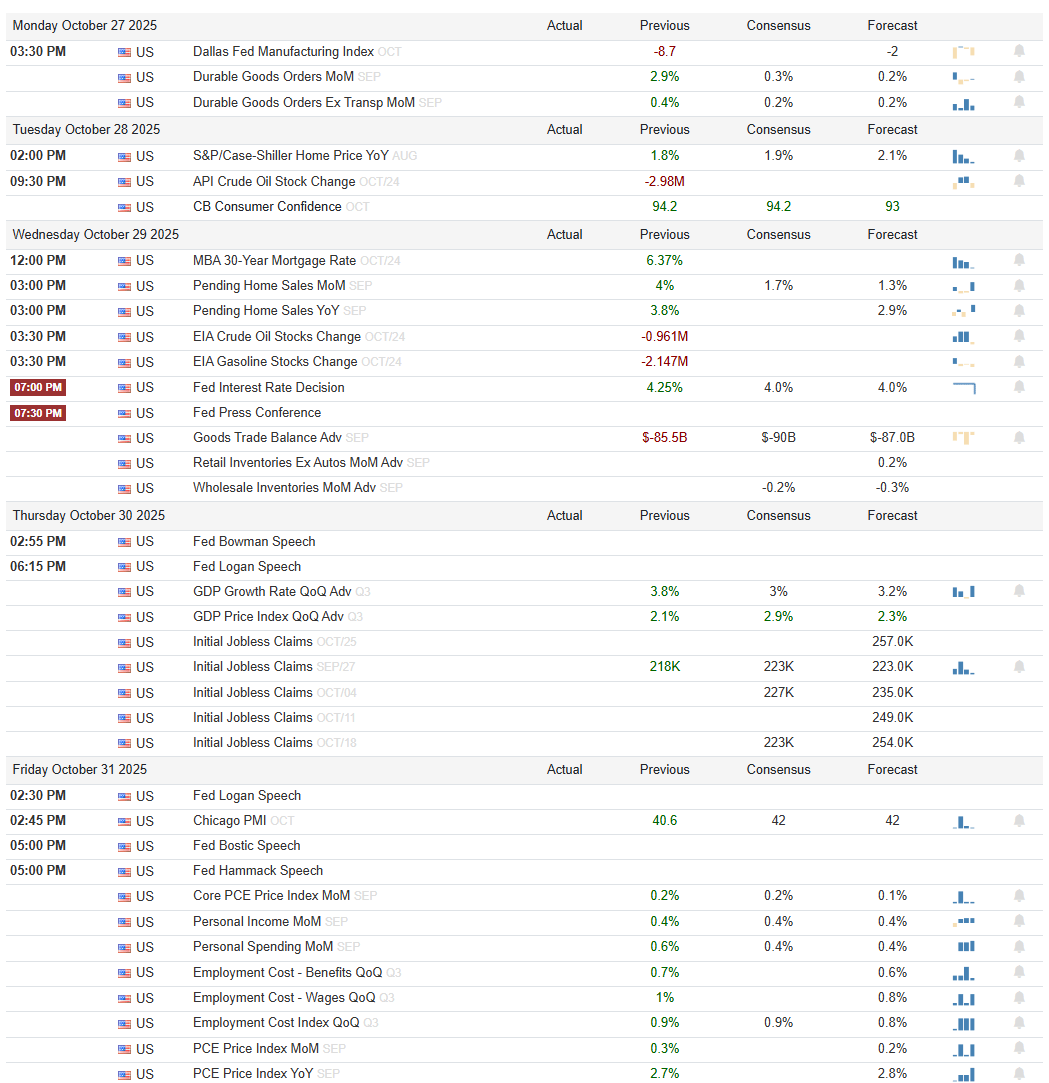

Another big macro week. The pinnacle being Wednesdays FED Decision at 7:00pm EST. On Friday we have several FED speakers. With the government shut down I’m not sure how many of the other expected numbers will be published. Macro is not something that I’m overly thinking about this week. I think it’s probably not going to be a big surprise. I think earnings are more important to the market.

Bullish overall. Have a great week!

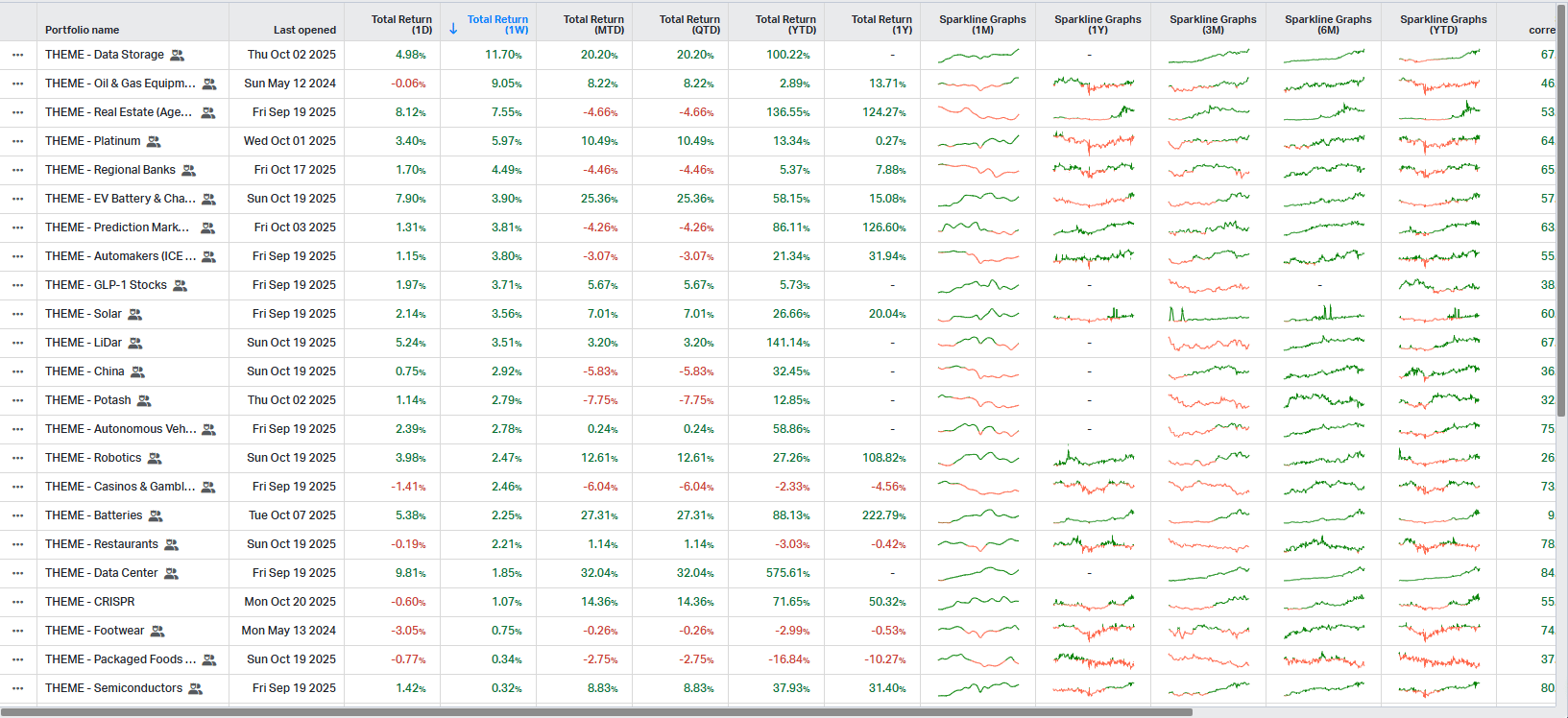

Theme Watch

Lots of the obvious Themes still strong this week but I’m still noting Oil & Gas as improving, Real Estate, Regional Banks and China. More defensive and slower moving areas developing on weekly and daily charts. This could be a long process and I’m just noting improving strength. The speculative themes are still hot right now.

I’m hoping we get some new merchandise from earnings in the next few weeks. Noting improving strength helps open the mind to a new theme or new sector that could be emerging. Get yourself thinking, that’s the aim of the process.

Earnings Highlights

BLACK - Chart

GOLD - Market Importance

Monday :

(Before Market Open) - DQ

(After Market Close) - CAR, RMBS, CDNS, NUE, CFLT, FTAI, AGYS, NE, OLN

Tuesday:

(Before Market Open) - SOFI, UNH, RCL, W, REGN, NEE, VFC, WGS, HUBB, RGEN, EDU, INCY, MTLS, ZDGE

(After Market Close) - V, EXE, MOD, LRN, RYI, ST, RRR, TYGO, BBNX, ORN

Wednesday :

(Before Market Open) - BA, CNC, ETSY, AMRN, COCO, OPFI, AROC, GNRC, GTES, EXTR, FULC, LFUS

(After Market Close) - META, MSFT, CMG, CVNA, NOW, TMDX, TDOC, VNDA, ATRC, CMPR, EBS, LXU, RRX, SCI, WAY, AWRE, FPH, WOLF

Thursday:

(Before Market Open) - MA, COMM, AAP, MO, AAMI, EXP, TEX, TT, CNX, LECO, PACK, PHAT, PRM, WCC

(After Market Close) - COIN, NET, GILD, GDYN, ILMN, INGM, NVST, SPXC, STRT, ALHC, AXTI, RMNI, FIP, GSIT

Friday:

(Before Market Open) - PRLB, OIS, BFLY, CVX, XOM

Next weeks full earnings watchlist on TradingView can be accessed here.

Macro Events (Eastern Time)

Delayed Reaction Watchlists:

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

Have a Great Week!

Born Investor

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply