- Stocks in Play

- Posts

- The Week Ahead : 24th - 28th November 2025

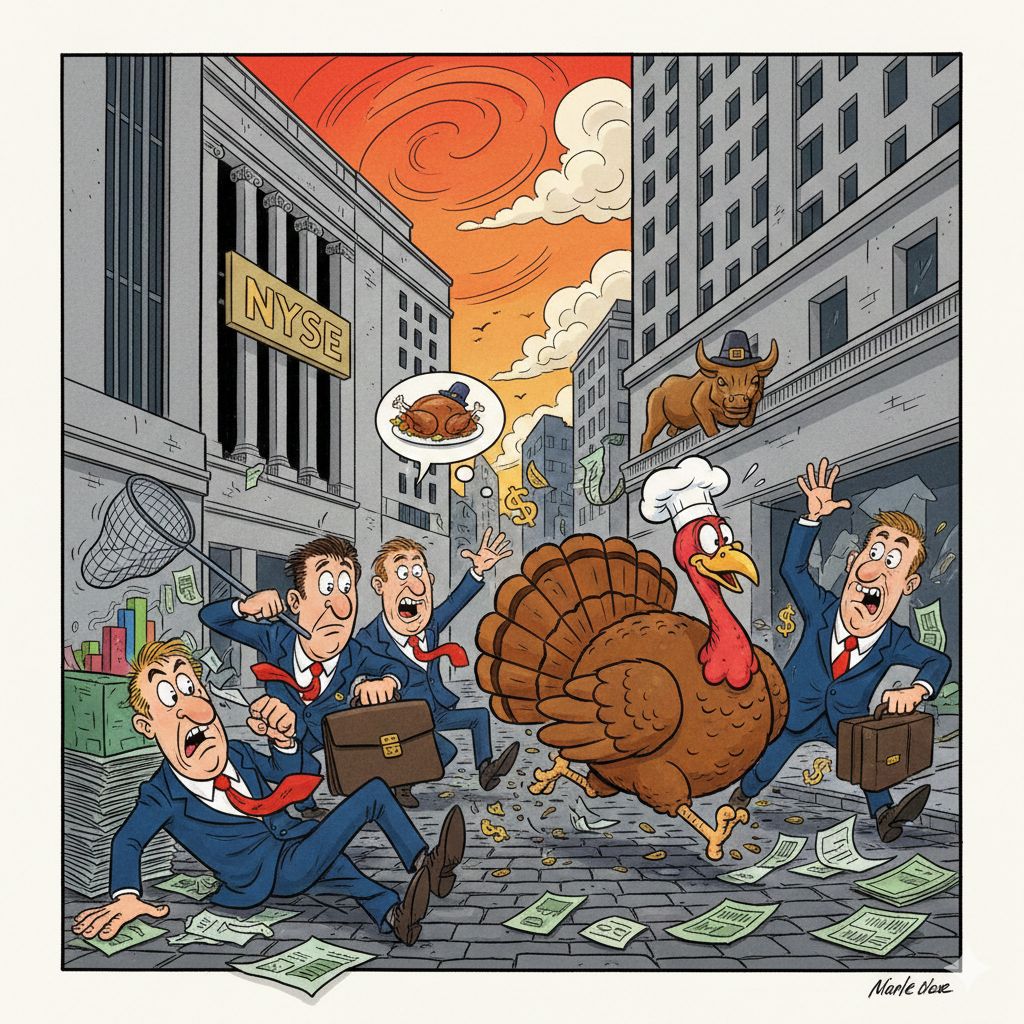

The Week Ahead : 24th - 28th November 2025

Highlights: Short Week, TradingView Giveaway!

The Week Ahead : 24th - 28th November 2025

Highlights: Short Week, TradingView Giveaway!

Thanksgiving week feels like the right time to give something back.

I'm giving away a TradingView Ultimate Annual Subscription — worth $3,000.

This is the top tier: advanced charts, unlimited indicators, extended historical data, priority support, and everything else TradingView offers. This is an institutional level subscription.

How to Enter:

Just click here to enter: Form Link

Takes 10 seconds. That's it.

I'll draw the winner on Thanksgiving Day and announce it on X.

Want a second entry? I'm also running this giveaway on X/Twitter — follow instructions here to give yourself a second opportunity.

Why I'm doing this:

This newsletter exists because you show up and read it. Whether you've been here from the start or just subscribed last week, I'm grateful you're here. So this is my way of saying thank you.

Good luck!

The Week Ahead

Happy Thanksgiving Week to all those that celebrate it. There are some reasonably big Earnings names this week despite it being a short week. I’ve flagged some charts below that look reasonable on the weekly. SMTC, ZM, KSS, AMTM, ADSK, AMBA and more listed below. ANF looks like a short earnings setup if results are negative.

The issue this week is that a lot of market participants will be getting out of the offices early Wednesday or even Tuesday. I generally try to avoid short weeks but I will be doing my regular routine considering the earnings that are occurring. I would temper expectations however and know that it can be a low volume whipsaw environment to trade in. Especially Wednesday and Friday.

On the Macro front we get US Retail Sales & PPI on Tuesday @8:30am and then Home Prices @ 9:00am Eastern.

Other than that I expect this to be a nothing week. The market is nowhere near out of the danger zone. Crypto is leading to the downside. The bounce on Friday gives us a low to work against to see if this can form the range but I think we should expect to be on rations for another few weeks at the very minimum. The run from April to October was incredible. The market needs breaks and stocks need to reset. Getting that mindset that things usually just take time will save you a lot of money and heartache. Taking that into consideration there is no better week than Thanksgiving to take some time off the screens and rest up!

Reminder I don’t intend to publish this week unless I see something irresistible.

So Happy Thanksgiving all in advance!

All the Best,

Sean

Theme Watch

Minerals/Commodities did well last week. Notably Lithium on supply shortages. SGML still looks good on the weekly chart. Some interesting strength in Consumer Defensive/Discretionary Retaillers. WMT was a solid pick this week. Interesting to see if it can follow through. I think that gives us an idea where the money is currently going. LLY was a great trade for us recently. Healthcare has been strong as well as Biotechs.

Personally I think many charts still need another few weeks here to firm up but it’s good to be thinking about future leading groups.

Earnings Highlights

BLACK - Chart

GOLD - Market Importance

Monday :

(After Market Close) - ZM, SMTC, FLNC, WWD

Tuesday:

(Before Market Open) - ANF (Short), KSS, BURL, AMTM, MOV, EMBC, GASS

(After Market Close) - ADSK, AMBA, SNT, SB

Wednesday :

(Before Market Open) - CMBT

Next weeks full earnings watchlist on TradingView can be accessed here.

Macro Events (Eastern Time)

Delayed Reaction Watchlist:

Strong Catalysts : Stocks that I feel have the strongest catalysts/themes

Most Recent : The catalysts I’m tracking in the last few days that may offer Day 2,3,4 entries

Stocks of Notable Interest : On these I’m waiting for a catalyst or secondary catalyst that I think may occur

This may adjust over time. I’m always looking to improve my process and refine it.

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

Have a Great Week!

Born Investor

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply