- Stocks in Play

- Posts

- The Week Ahead : 23rd - 27th February 2026

The Week Ahead : 23rd - 27th February 2026

Highlights: Earnings, Anthropic Enterprise Event & New Leaders

The Week Ahead : 23rd - 27th February 2026

Highlights: Earnings, Anthropic Enterprise Event & New Leaders

Sources & Services I Use in my Trading:

Finviz - Scanning, Short Interest, Float, Fundamentals

Tradingview - Charting & Scanning

BiopharmaIQ - FDA Calendars & Upcoming Biotech Catalysts

Koyfin - Fundamental Data

Tradersync - Trade Journal

Week Overview

Market Setup: Resilient but choppy market conditions

Key Themes: With the Macro Tariff news we can expect more Administration volatility, Setups and strength emerging, Positions are working.

Huge Earnings Week - Core focus of my week are earnings

Lot’s of charts developing. Potential new leadership names will emerge soon - Energy, AI Infra, Software Turnaround

Major Anthropic Enterprise Event Tuesday Feb 24th - This is likely to move tech names.

Focus Areas: Very little on major macro front. Just the usual FED Speakers. They may have some minor impact with commentary after the Tariff decision but for the most part this is not a priority of mine. I see some solid charts this week for earnings. Notably I like ZM, TMDX and NVDA amongst many others.

I’m cautiously bullish. Market has been resilient but we have essentially corrected with time rather than price on the indices while many high beta names have been really smashed. This is good and we want to see it. The main thing is to see continued follow through on good charts. We can be early to leading names. Continue focusing on charts. Don’t get distracted by macro drama.

Calendar Notes: Major Anthropic Event on Feb 24th. This is an enterprise agent event. It is likely to be market moving for tech. You can see the impact any announcements from AI Companies can have - The Briefing: Enterprise Agents

Macro Events (Eastern Time)

Here's your economic calendar formatted for the week:

Monday February 23 2026

08:00 AM - Fed Waller Speech

10:00 AM - Factory Orders MoM DEC (Previous: 1.1%, Consensus: 0.9%)

10:30 AM - Dallas Fed Manufacturing Index FEB (Previous: -3.5)

Tuesday February 24 2026

08:00 AM - Fed Goolsbee Speech

08:15 AM - ADP Employment Change Weekly (Forecast: 10.25K)

09:00 AM - Fed Bostic Speech

09:00 AM - Fed Collins Speech

09:15 AM - Fed Waller Speech

09:30 AM - Fed Cook Speech

03:15 PM - Fed Barkin Speech

03:15 PM - Fed Collins Speech

04:30 PM - API Crude Oil Stock Change FEB/20 (Previous: -0.609M)

Wednesday February 25 2026

07:00 AM - MBA 30-Year Mortgage Rate FEB/20 (Previous: 6.17%)

09:35 AM - Fed Barkin Speech

10:30 AM - EIA Crude Oil Stocks Change FEB/20 (Previous: -9.014M)

10:30 AM - EIA Gasoline Stocks Change FEB/20 (Previous: -3.213M)

01:20 PM - Fed Musalem Speech

Thursday February 26 2026

08:30 AM - Initial Jobless Claims FEB/21 (Previous: 211K, Consensus: 210.0K)

10:00 AM - Fed Bowman Speech

Friday February 27 2026

08:30 AM - PPI MoM JAN (Previous: 0.3%, Consensus: 0.3%)

09:45 AM - Chicago PMI FEB (Previous: 52.6, Consensus: 51)

Earnings Highlights

Format:

🟡 = Market importance (market-moving names)

⚫ = Chart setup (tradable technical setup)

Monday Before Open: AXSM, GLPG

Monday After Hours: BWXT, ADEA, VIR, AESI, BOOM, FWRD, INVX, VVX

Tuesday Before Open: CIFR, DOCN, DRS, NRG, AS, KDP, LTH, SHLS, AHCO, ARVN, AWI, AXGN, ESTA, NOVT, OPCH, PTLO

Tuesday After Hours: CAVA, FSLR, TMDX, SEI, DAWN, CLNE, RRC, CBLL, CYTK, HYLN, IGIC, JAZZ, MATX, PARR, SUPN, TYGO, RCKY

Wednesday Before Open: HUT, PLAB, YOU, ALLT, AMRN, DRVN, ESEA, FSS, LFST, MGPI, HOV

Wednesday After Hours: NVDA, ZM, URBN, GRBK, VECO, ADTN, FTAI, IMAX, CPRX, CSV, GPRK, PRSU, SARO, TKO

Thursday Before Open: VST, Q, HTZ, NVAX, ACU, CLMB, COLL, CRON, INDV, MNKD

Thursday After Hours: CRWV, WULF, MP, AAOI, AMBA, AGO, AMPH, BWMX

Friday Before Open: UUUU, DIBS, GSAT, DK, TAC

Full Earnings Watchlist: TradingView Link

Biotech Catalysts

Expected This Week:

ANRO, AVBP, KPTI, TBPH, MLTX, ARQT, TARA, BFRI, ASND, RYTM, PEPG, APGE, INSM, VRDN, EWTX, PCVX, ORKA, GOSS, XENE, IOVA, IMMP, OCGN, KOD

Chart Assessment: The above are expected in Q1. These are the ones I’ve identified with Tradable charts or developing charts.

Note: Never front-run biotech catalysts. Wait for the catalyst to hit, then assess if the reaction is tradable. Dates are estimates and can shift.

Full Q1 Biotech Watchlist: TradingView Link

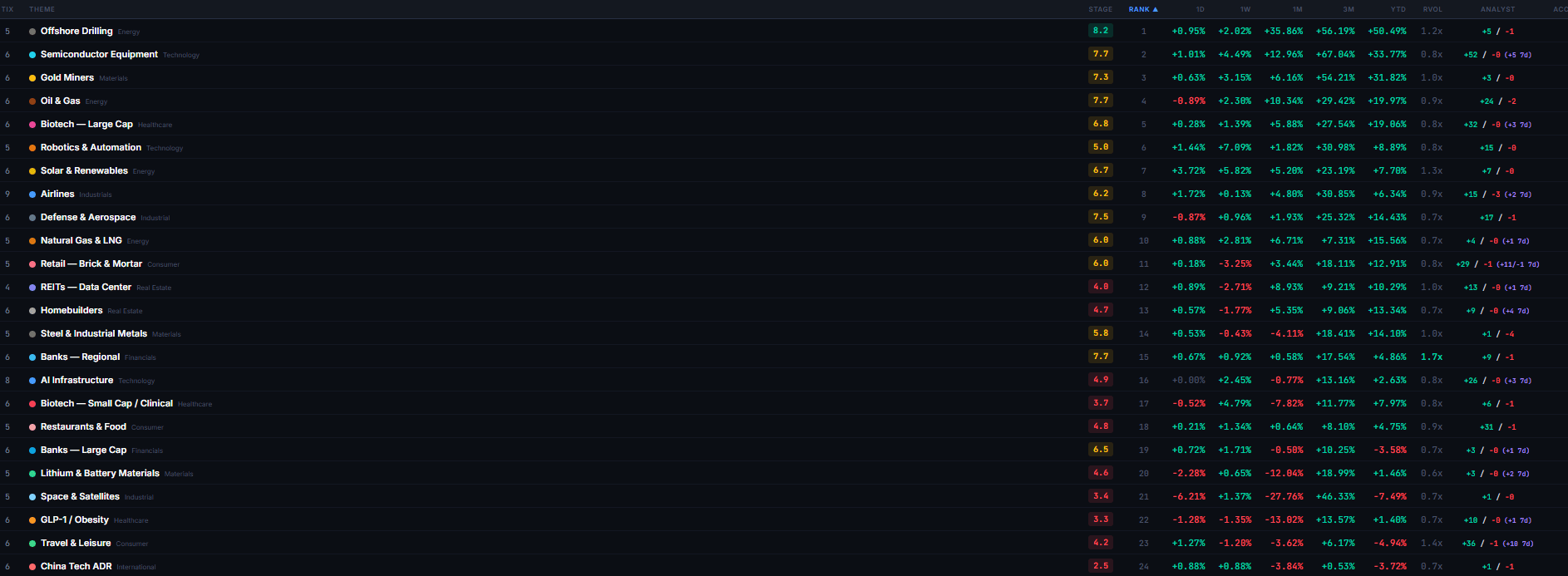

Theme Watch

YTD Sector Strength: Strength has been consistent all year. AI Infrastructure, Oil & Gas. we’re seeing some strength in Solar names and select Software is getting off the mat. Biotechs are also beginning to work well once again, though these are individualistic in nature.

This week’s earnings will likely shake up some areas.

Emerging Themes:

Solar Strength

Oil & Gas (Off Shore Drilling)

AI Infrastructure

Delayed Reaction Watchlist:

Monitoring:

Full Delayed Reaction list below. This is a very busy earnings week. My focus is on Day One setups this week not delayed reactions but alerts are set on many of these names.

Have a Great Week!

Born Investor

Like what you're reading? Support the analysis via ☕ Ko-Fi

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply