- Stocks in Play

- Posts

- The Week Ahead : 20th - 23rd January 2026

The Week Ahead : 20th - 23rd January 2026

Highlights: SCOTUS Decision, Claude Code and Earnings

The Week Ahead : 20th - 23rd January 2026

Highlights: SCOTUS Decision, Claude Code and Earnings

The Week Ahead

Short week this week with Monday closed. We’ve had all the Greenland drama in the news and Tariff threats this weekend. I think we should all be well and truly wise to this playbook now. Big threats, small actions. This may create some volatility but I wouldn’t waste your time reading into it. We also have the looming Supreme Court decision which could also hit this week. Be prepared for Volatility this week.

My big focus is Claude Code/Cowork which has caused this big sell-off in SaaS. Earnings season is here and software companies guidance and results are going to be very important for the health of the market. Counterintuitively if no SaaS company guides down here then it seems like the AI threat is overblown and just a narrative. That’s the biggest danger. To keep the AI train going then some disruption needs to be proved.

We’re now in earnings season so I’m open minded and looking for new themes and information.

On the macro front we have US PCE Thursday morning @ 10am ET and US PMIs on Friday morning @ 9:45am ET.

Not a lot of tradable earnings setups that excite. A lot of slow moving banks and NFLX which doesn’t have a chart I will trade but will set the tone for earnings.

Biotech - I’ve added a new section of stocks that are expected* to have Biotech catalysts before year end. I’m taking this data from BPIQ. This is a new process update for me. Biotech data readouts are always estimates but if it proves to be reasonably accurate on timing then for me it’s a benefit to go through the relevant charts in advance and highlight just like I do with earnings. It’s essentially an added efficiency in my daily routine and familiarity with the stocks in question. This weeks list is below.

Biotechs - Full Biotech Watchlist Q1 2026

I currently don’t see any fantastic charts in Biotech watchlist.

Please note: I would NEVER try to front run an anticipated Biotech catalyst. I’m always waiting for it to hit then deciding if the reaction is tradable. Catalyst dates are estimates and can vary widely.

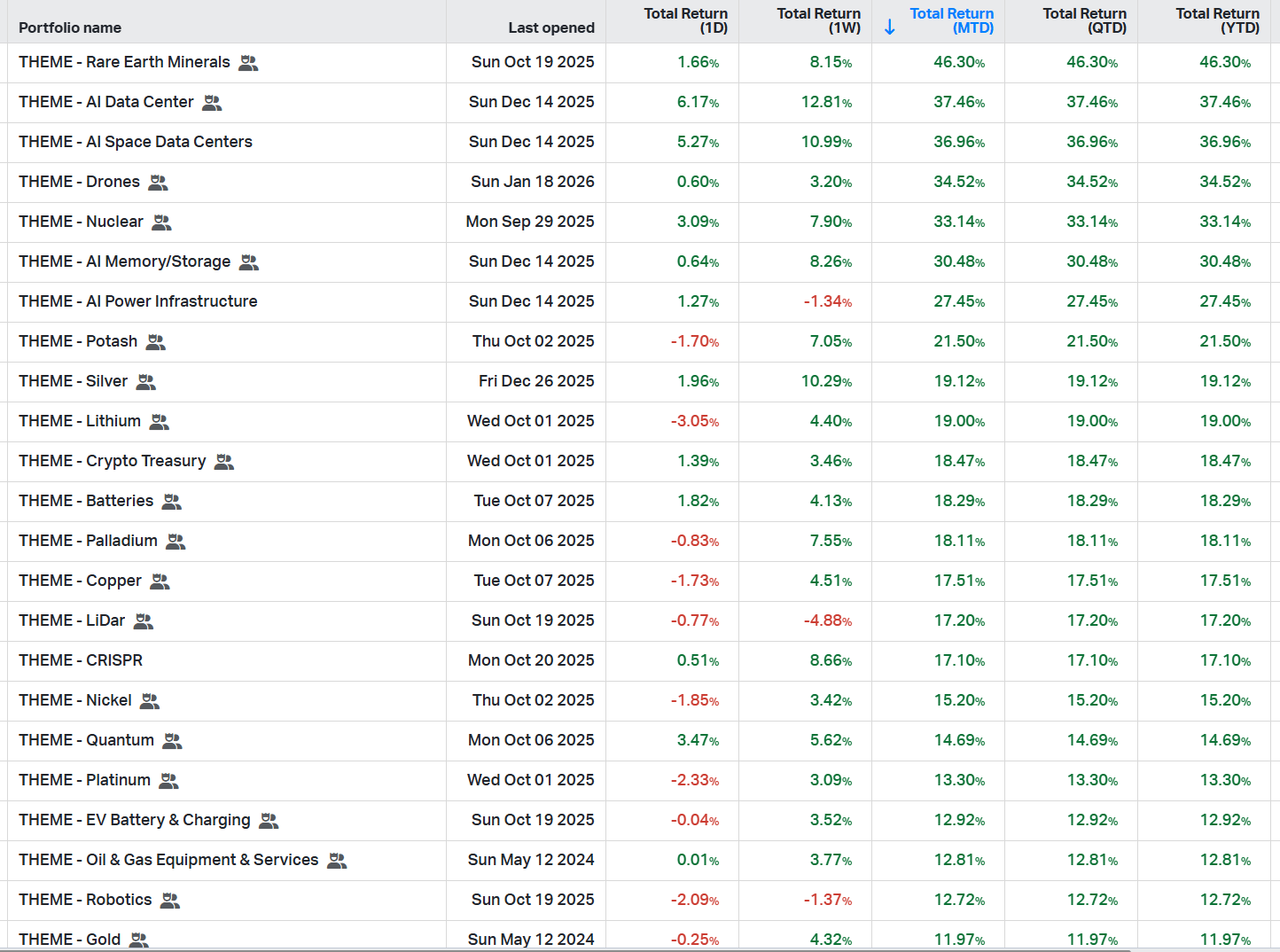

Theme Watch

A look at YTD strength in sectors. We’ve seen some really strong moves in certain sectors like Space stocks, Rare Earths and Data Centers. Earnings season is starting so I’ll be taking my main queues from that for the next few weeks. Notable though that speculative themes and small caps have been super strong..

Earnings Highlights

BLACK - Chart

GOLD - Market Importance

Tuesday:

(Before Market Open) - MMM, FOR, SPWR

(After Market Close) - NFLX

Wednesday :

(Before Market Open) - TEL

(After Market Close) - KMI

Thursday :

(Before Market Open) - ABT, NG

Friday:

(Before Market Open) - ISRG

Biotechs with Potential Catalysts -

Next weeks full earnings watchlist on TradingView can be accessed here.

Macro Events (Eastern Time)

Delayed Reaction Watchlist:

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

Have a Great Week!

Born Investor

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply