- Stocks in Play

- Posts

- The Week Ahead : 17th - 21st November 2025

The Week Ahead : 17th - 21st November 2025

Highlights: In Jensen We Trust

The Week Ahead : 17th - 21st November 2025

Highlights: In Jensen We Trust

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

The Week Ahead

NVDA is clearly the most important earnings report this week. There are some other reasonable charts that I’ve outlined below but I’m quite cautious on the market here. For a catalyst trader there is certainly no rush right now. There is some potential in China charts of which a lot have earnings this week but I’m really not sure if that’s where you want to speculate right now either but it’s worth pointing out.

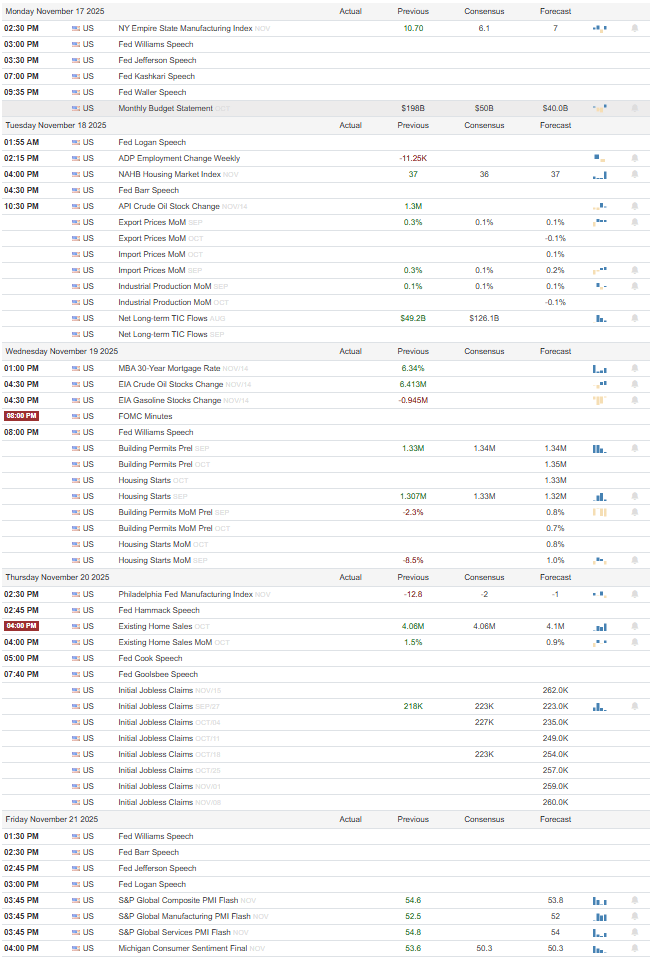

FOMC Minutes will be released Wednesday @ 2pm ET, Jobs Report Thursday @ 8:30am ET. There are also plenty of FED Speakers this week. Chances of a December rate cut have dropped drastically. Expect volatility to continue with regard to this narrative.

Overall a cautious approach is prudent. Let’s see if we can continue the bounce into the coming week and if NVDA can renew market faith in the AI trade. Regardless I expect the QQQ to be range bound for the foreseeable future. Which is fine for us as strong charts and catalysts can begin to work in those conditions but for now we need to see if that range is being established.

Wishing you all a great week trading!

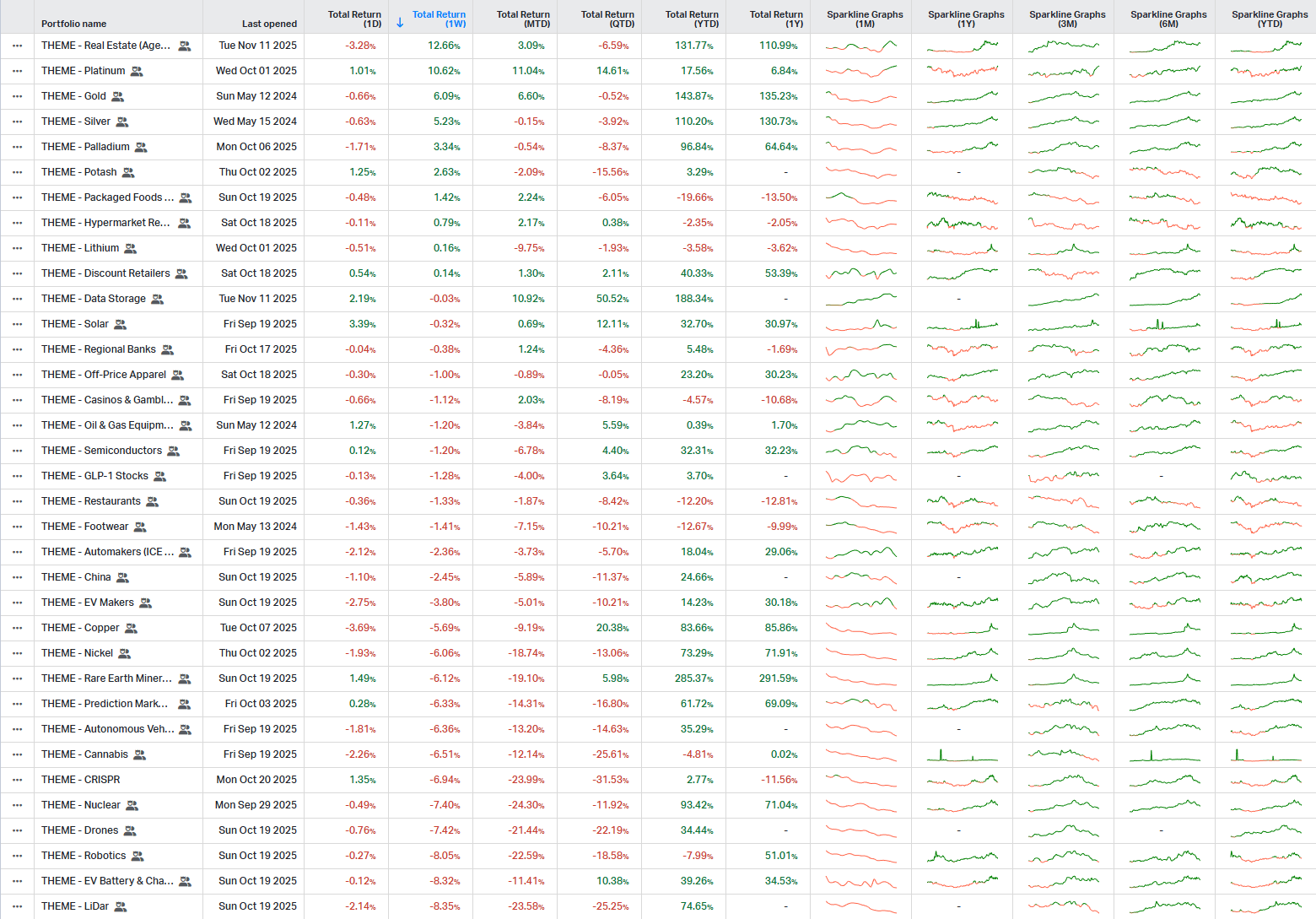

Theme Watch

We saw some renewed strength in Commodities last week. Platinum, Gold, Silver etc. not a lot else to take away in terms of strength. The rest of the market tried to bounce Friday. It remains to be seen whether any of that follows through or fails in the coming week.

Earnings Highlights

BLACK - Chart

GOLD - Market Importance

Monday :

(Before Market Open) - CRGO, JKS, YMM

Tuesday:

(After Market Close) - VREX

Wednesday :

(Before Market Open) - DY, WSM, GLBE, LUXE

(After Market Close) - NVDA, CRNC, JOYY

Thursday:

(Before Market Open) - WMT

(After Market Close) - ALLT, MDWD, RERE, VIPS, VNET, DSX, VEEV, GAP, ESTC

Next weeks full earnings watchlist on TradingView can be accessed here.

Macro Events (Eastern Time)

Delayed Reaction Watchlist:

I’ve cleaned this list up to reset it to make it more actionable. In future I’ll be limiting this list to only really high conviction catalysts as well as delayed reactions in the few days after initial move. The more I look at delayed reactions the more it’s a waste of time for me to track things for too long. I really only want to be taking Day 2 and Day 3 max on most catalysts and possibly a more delayed entry on something I feel has very big potential. Keeping the universe small is important and this watchlist has grown too long.

I’m hopeful that it will be more useful for others to track also.

The new sections I’m using are:

Strong Catalysts : Stocks that I feel have the strongest catalysts/themes

Most Recent : The catalysts I’m tracking in the last few days that may offer Day 2,3,4 entries

Stocks of Notable Interest : On these I’m waiting for a catalyst that may or may not occur.

This may adjust over time. I’m always looking to improve my process and refine it.

If you find this article and my other work helpful then feel free to Buy me a Coffee. It’s the thought that counts.

Have a Great Week!

Born Investor

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply