- Stocks in Play

- Posts

- Stocks in Play - September 8th 2025

Stocks in Play - September 8th 2025

Stocks in Play: DNTH, RAPP, QS, CRYPTO

Stocks in Play - September 8th 2025

Stocks in Play: DNTH, RAPP, QS, CRYPTO

Welcome to today's Stocks in Play report. Below are the key stocks to watch, along with brief x-ray and analysis.

If you find this Newsletter helpful and ever want to say thank you then feel free to Buy Me a Coffee. It’ll inspire me to work faster….

Honorable Mention to:

RAPP: Rapport Therapeutics (NASDAQ: RAPP) announced positive topline results from its Phase 2a trial of RAP‑219 (RAP‑219‑FOS‑201) in patients with drug‑resistant focal onset seizures. 85.2% of patients achieved ≥30% reduction in long episodes (LEs), an objective electrophysiological biomarker, from baseline over the 8‑week treatment period (p < 0.0001). Good Chart. Recent IPO. High Short Interest. It’s moving very hard Pre Market, Would have much preferred it to open at $30 (IPO High) and go from there. Looking for an undercut and rally type entry rather than ORB on this if the opportunity arises.

NOTE: DNTH is a similar Biotech I flagged this morning, It has had a sharp reversal but worth setting alerts on, Positive Data & High SI.

X-Ray DNTH: Industry Group: Biotechnology, Market Cap: 852.99M, Float: 23.48M Short Interest 25.49%, Days to Cover: 16.56, Exchange: NASDAQ

X-Ray RAPP: Industry Group: Biotechnology, Market Cap: 524.11M, Float: 17.46M Short Interest 17.31%, Days to Cover: 16.86, Exchange: NASDAQ

QS: QuantumScape and Volkswagen’s PowerCo unveiled the world’s first live demonstration of a solid-state lithium-metal battery powering a vehicle. The event featured a Ducati motorcycle running on QS’s QSE-5 cells, produced with its proprietary Cobra separator process. Stock has had a big pullback. $9.50 is the support area I see today.

X-Ray QS: Industry Group: Auto Parts, Market Cap: 4.44B, Float: 407.05M Short Interest 12.81%, Days to Cover: 1.23, Exchange: NYSE

CRYPTO Treasury: Hard to ignore the Crypto Treasury moves this morning. OCTO up over 1000% Pre Market after a PIPE Investment. Note BMNR are an investor, albeit just $20m. Still worth setting alerts for delayed reaction on this. OCTO is not something I’m trading. FORD is another name that has had a massive Private Placement for SOLANA Treasury. $1.65b. I’ll monitor FORD and BMNR (Delayed Reaction Trigger).

Earnings Highlights

Tuesday:

(After Market Close) - ORCL, AVAV, GME, SNPS, RBRK

Wednesday:

(Before Market Open) - CHWY

Thursday:

(After Market Close) - ADBE,

Next weeks full earnings watchlist on TradingView can be accessed here.

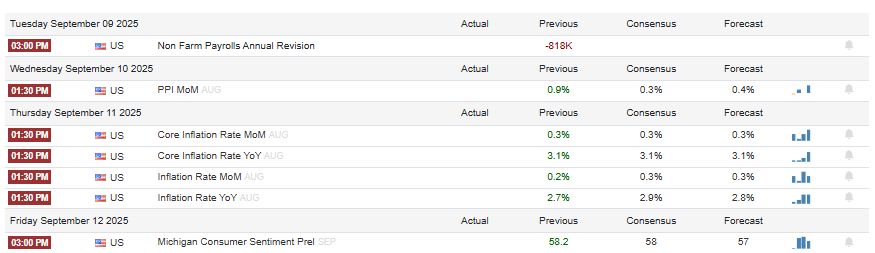

Macro Events (Eastern Time)

Market Awareness

Not much has changed since last week. We are still chopping around in a range. It doesn’t pay to be too bearish here in my opinion unless we see a real break down. Otherwise you’re just going to chop yourself up. Less trades and lower your risk if you are unsure. With Catalyst trading in my opinion it never pays to totally sit out. I subscribe to the Trade Factory method. My trade factory runs every day no matter what, I will go through it. There are times where quality control needs to be higher and now is a situation for that. I am not bearish and I think it is foolish to try pick a top in a Bull Market IF you trade catalysts as your core setup. Ignore the Hindsight Geniuses that will tell you why something happened after the fact.

Tomorrow we get the Payrolls revision which will be closely watched. Biotechs are working well at the moment. Not a lot of follow through on anything else currently, just consolidation for the most part.

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk + Earnings Data (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply