- Stocks in Play

- Posts

- Stocks in Play - July 31st 2025

Stocks in Play - July 31st 2025

Stocks in Play: CVNA, VRME, APLD

Stocks in Play - July 31st 2025

Stocks in Play: CVNA, VRME, APLD

Welcome to today's Stocks in Play report. Below are the key stocks to watch, along with brief x-ray and analysis.

If you find this Newsletter helpful and ever want to say thank you then feel free to Buy Me a Coffee. It’ll inspire me to work faster….

I use Benzinga Pro (Essential) for 90% of my research each day. I have recently subscribed to a LIFETIME subscription for $1650. This is incredible value. If this is something you’d be interested in then shoot me an email ([email protected]) and I’ll put you in touch with the Rep to receive the agreed price. I couldn’t recommend it highly enough.

1) Carvana Co. (CVNA) (Rating: B+, Multi-Day)

X-Ray CVNA: Industry Group: Auto & Truck Dealerships, Market Cap: 71.44B, Float: 123.12M Short Interest 10.27%, Days to Cover: 3.52, Exchange: NYSE

Standout Earnings, Strong EPS Beat ($1.28 vs est. $0.97) Solid Beat on Revs up 42% YoY, KPIs strong - Units Sold 41% YoY. Adjusted EBITDA 66% YoY. Margins Growing. Strong inflection and profitability. Has been consolidating in an orderly fashion on the Daily. The Short thesis is now based on Valuation.

Honorable Mention to:

VRME: Signed a three year strategic agreement with UPS for API Access. The collaboration grants PeriShip integration rights with UPS’s APIs and logistics data, enabling services such as proactive monitoring, weather tracking, and shipment issue resolution. This is a story stock, low priced low float but moving well pre market on volume. Year long base. Neglected.

X-Ray VRME: Industry Group: Security & Protection Services, Market Cap: 8.52M, Float: 10.23M Short Interest 0.77%, Days to Cover: 0.24, Exchange: NASDAQe: NASDAQ

Highly Anticipated IPO: FIG will IPO today. Similar setup to CRCL, coming in with tradeable float of about 37 million shares, 40x Over Subscribed, hyped IPO, $20b Market cap and priced at $33 per share. 2025 Q1 Revs grew 46% YoY, 90% Gross Margins, High Rule of 40 SaaS score. They are profitable. This is a highly anticipated IPO for the Adobe competitor. We won’t know when it IPOs today but I I would watch it closely in the coming days and weeks for sure.

There are a lot of names this morning and in trying to narrow down and keep it simple I have exhausted myself! I like RBLX, APLD & KGC as secondary watches. META for sure also is obvious. Rather than write these up I’m listing them here as these are also in my watchlist. CRWV is also on my radar with all of the CAPEX announced. Too many names but it’s difficult on days like this.

Delayed Reaction Watchlists:

Market Awareness

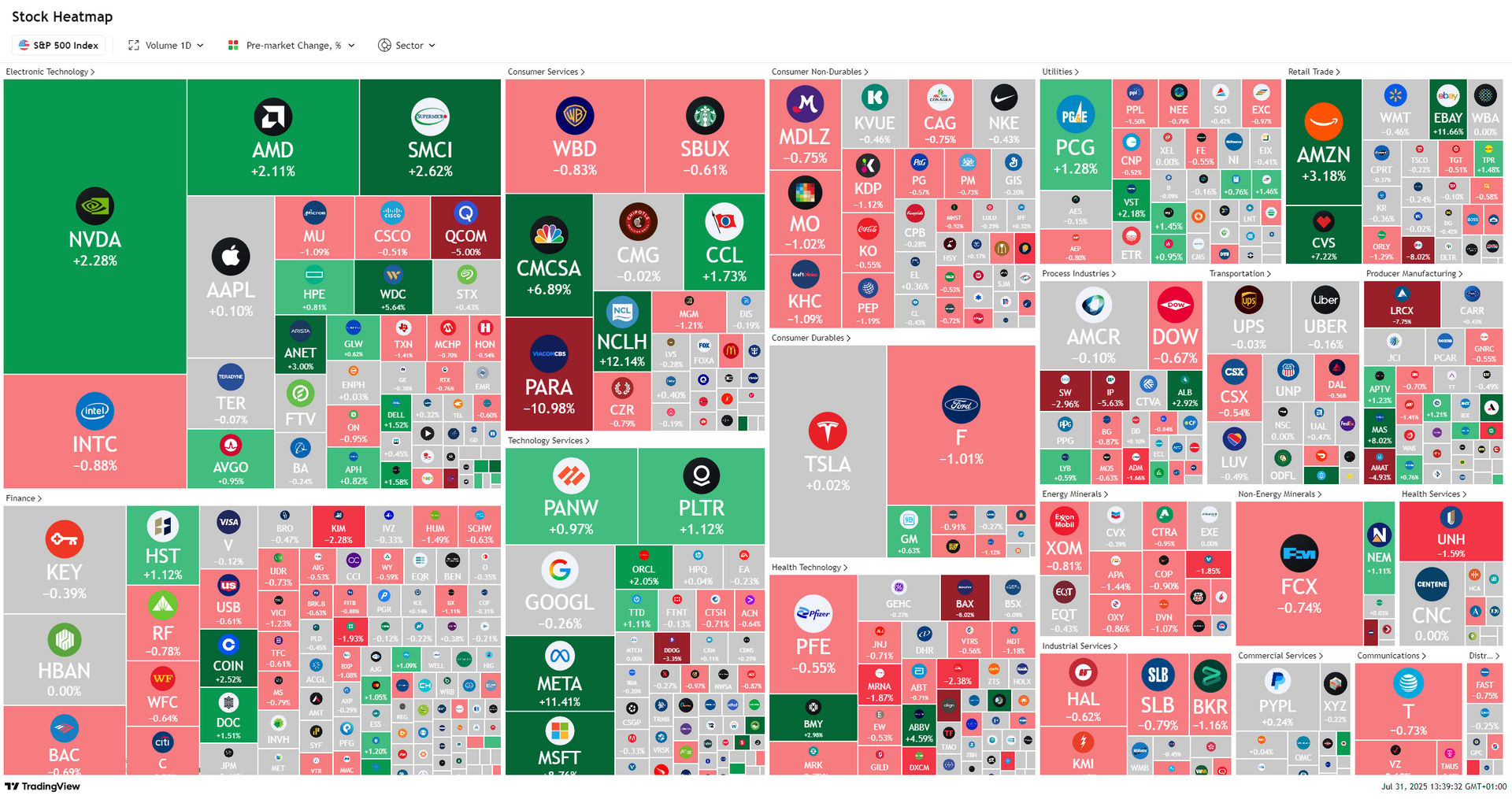

Huge gap up this morning on the back of the mega tech Results last night. Hard to be bearish at all here but I would be careful of FOMO at the open. We will likely see some profit taking in the big names. These are simply massive overnight moves and are concentrated in the Mega cap names as can be visualized in the heat map below. It’s also the final day of the month which can be a strange day in the market.

I’ve been seeing churn in positions for the past week or so, maybe this kicks off a few days of a short term blow off top in this run we will see. Cautious at the open, no chasing.

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk + Earnings Data (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply