- Stocks in Play

- Posts

- Stocks in Play - July 30th 2025

Stocks in Play - July 30th 2025

Stocks in Play: IXHL, COIN, TYGO, VFC, HOG

Stocks in Play - July 30th 2025

Stocks in Play: IXHL, COIN, TYGO, VFC, HOG

Welcome to today's Stocks in Play report. Below are the key stocks to watch, along with brief x-ray and analysis.

If you find this Newsletter helpful and ever want to say thank you then feel free to Buy Me a Coffee. It’ll inspire me to work faster….

I use Benzinga Pro (Essential) for 90% of my research each day. I have recently subscribed to a LIFETIME subscription for $1650. This is incredible value. If this is something you’d be interested in then shoot me an email ([email protected]) and I’ll put you in touch with the Rep to receive the agreed price. I couldn’t recommend it highly enough.

1) Tygo Energy (TYGO) (Rating: B+, Multi-Day)

X-Ray TYGO: Industry Group: Solar, Market Cap: 76.28M, Float: 28.85M Short Interest 0.21%, Days to Cover: 0.53, Exchange: NASDAQ

Strong Beat on EPS (-$0.07 vs est. -$0.10), Solid Beat on Revs (90% YoY), Large raise on Q3 Guidance, Narrowing losses, Approaching profitability, Improved margins. Nice Base, Low Priced stock, they will likely do a stock offering in the coming days.

Honorable Mention to:

X-Ray COIN: Industry Group: Financial Data & Stock Exchanges, Market Cap: 94.61B, Float: 201.98M Short Interest 6.52%, Days to Cover: 0.91, Exchange: NASDAQ

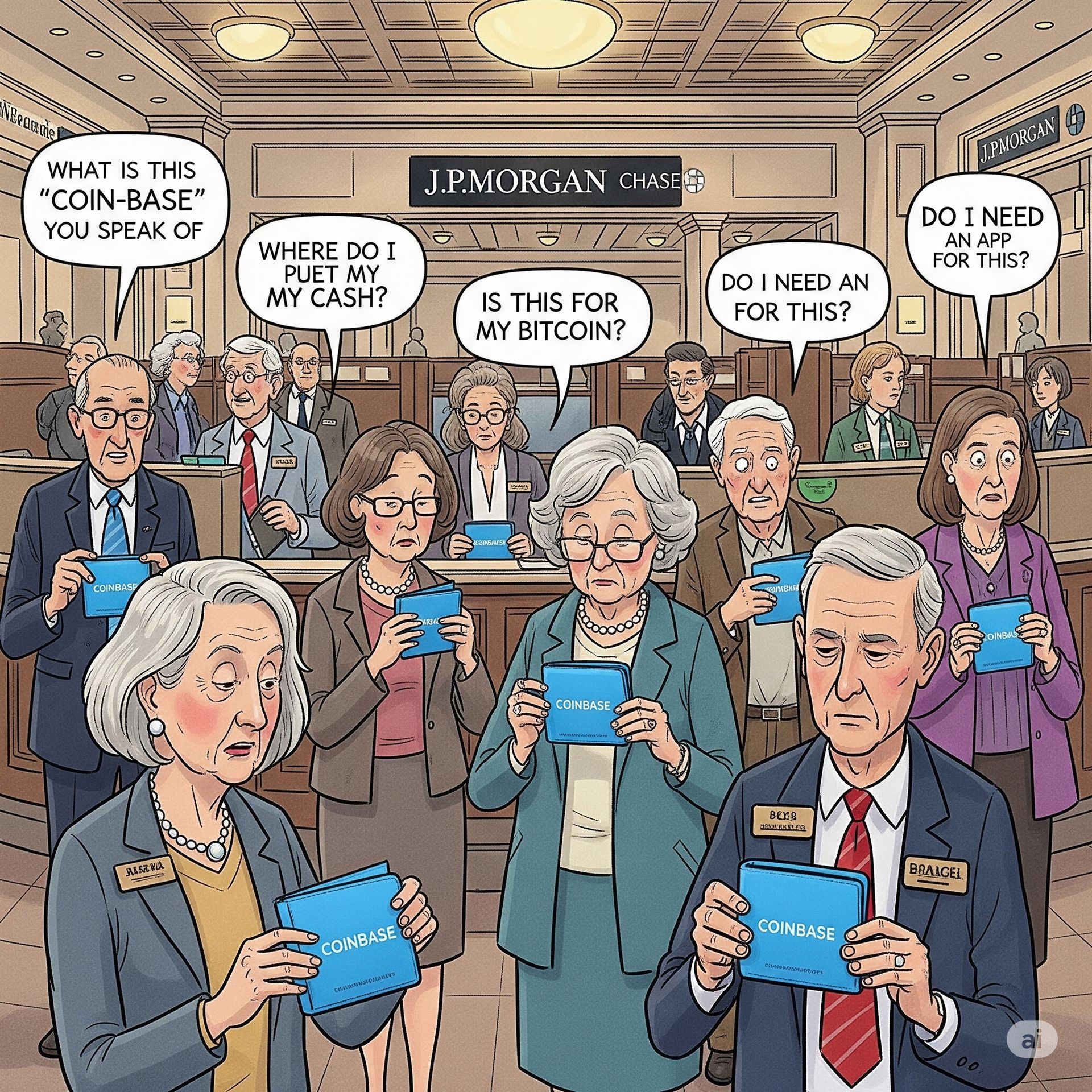

COIN: Significant partnership with JPM for Crypto API for JPM customers to connect to Coinbase Wallets. The stock has been strong for months and we’ve just had an orderly pullback from it’s first All Time High Test. This is a nice looking pullback catalyst setup in the Crypto theme in an institutional name.

X-Ray COIN: Industry Group: Financial Data & Stock Exchanges, Market Cap: 94.61B, Float: 201.98M Short Interest 6.52%, Days to Cover: 0.91, Exchange: NASDAQ

IXHL: Strong statistical and clinical results across multiple endpoints with excellent safety in Phase II Trial for Sleep Apnea Drug. Low Priced stock, Nice Chart pattern, Beware likely to do an ATM Offering During market hours. Has potential to make a strong move. Had a 700% One Day move in May. As this is a Biotech I am generally treating a large portion of any position as Day Trade only.

X-Ray IXHL: Industry Group: Drug Manufacturers - Specialty & Generic, Market Cap: 100.26M, Float: 73.14M Short Interest 5.40%, Days to Cover: 0.04, Exchange: NASDAQ

Secondary Watchlist: HOG & VFC are interesting Turn Around/Squeeze plays today. HOG had a big finance deal that transforms a lot of their Balance Sheet and VFC are having continued push toward a long touted overall Company Turnaround. The 20% Move on both gives me pause for today but both are worth watching for sure.

Delayed Reaction Watchlists:

Market Awareness

Today is a huge day in the markets between macro and earnings. I will proceed with caution. I’ve been rotating my risk up and down far quicker over the past 10 to 14 Days as we see much less follow through and Themes fade (in the short term). I would be happy if today might kick off some selling but I think it could just lead to more chop.

There are a ton of movers this morning. It makes it difficult to pick the winners but I think it’ll be more interesting to see the amount that fade. We saw some roll over yesterday in the markets, I had a lot of positions finally stop out. But that is to be expected after such an aggressive run. I’m Bullish overall.

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk + Earnings Data (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply