- Stocks in Play

- Posts

- Stocks in Play - July 29th 2025

Stocks in Play - July 29th 2025

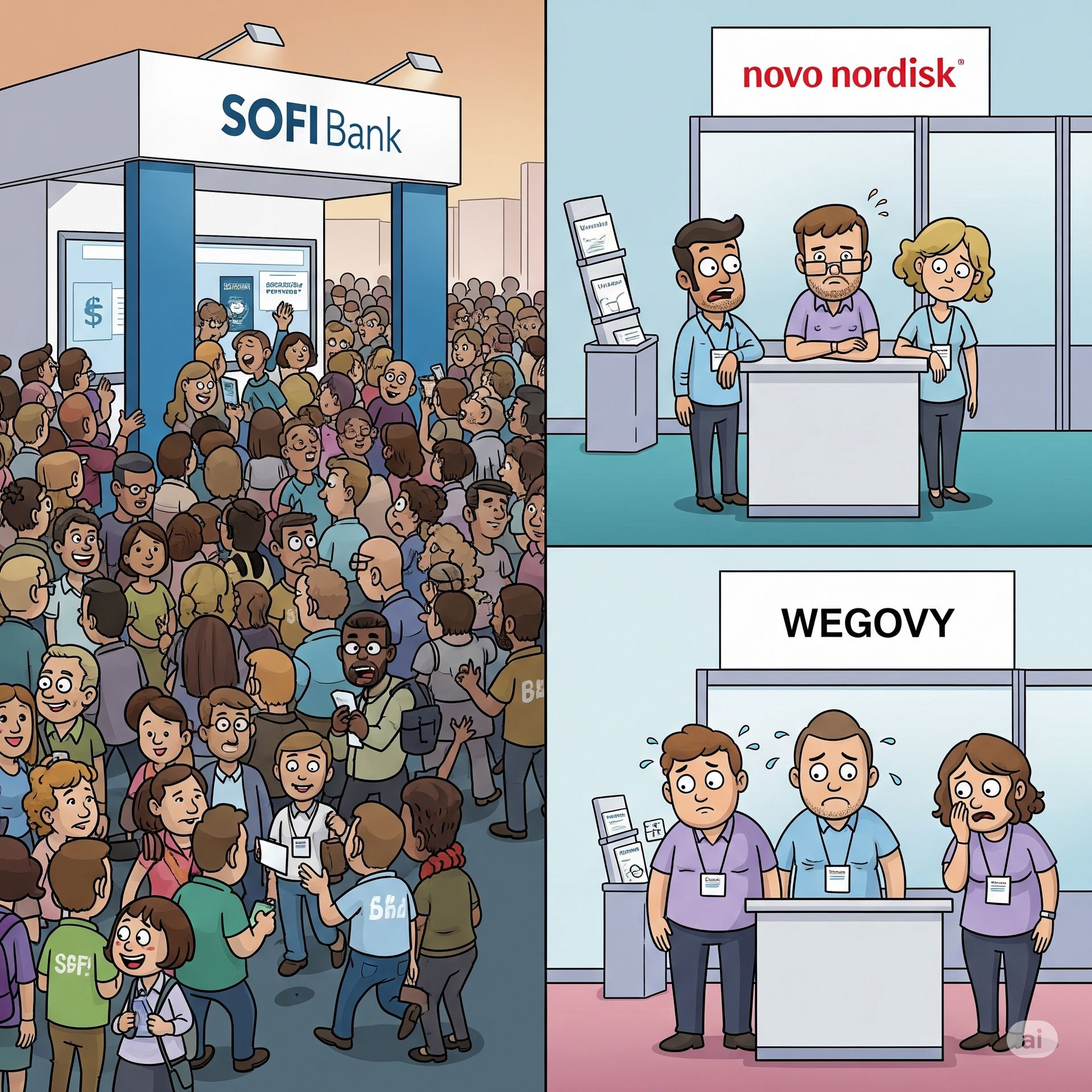

Stocks in Play: WGS, NVO, SOFI

Stocks in Play - July 29th 2025

Stocks in Play: WGS, NVO, SOFI

Welcome to today's Stocks in Play report. Below are the key stocks to watch, along with brief x-ray and analysis.

If you find this Newsletter helpful and ever want to say thank you then feel free to Buy Me a Coffee. It’ll inspire me to work faster….

I use Benzinga Pro (Essential) for 90% of my research each day. I have recently subscribed to a LIFETIME subscription for $1650. This is incredible value. If this is something you’d be interested in then shoot me an email ([email protected]) and I’ll put you in touch with the Rep to receive the agreed price. I couldn’t recommend it highly enough.

1) GeneDX Holdings Corp (WGS) (Rating: A-, Multi-Day)

X-Ray WGS: Industry Group: Diagnostics & Research, Market Cap: 2.42B, Float: 24.89M Short Interest 13.98%, Days to Cover: 3.06, Exchange: NASDAQ

Strong beats; Q2 revenue $102.7 M (+49%), EPS far above estimates (May not compare due to Acquisition), Adjusted gross margin up to 71%, Raised FY guidance significantly, Strategic Growth Fabric acquisition enhances AI platform and global scalability. Low Float, reasonably high Short Interest. Great Daily Chart.

Honorable Mention to:

NVO (SHORT): Announced a large slashing of FY Guidance, Replacing CEO. Complaining about competition (LLY) and compounders (HIMS etc.). Pursuing litigation against these companies. Seems like a total shit show. Big drop already but I think there is room to the low $40s. Very bearish overall for them particularly as LLY seem to be doing fine. Also I find that EU companies don’t get that same bounce that US companies do.

X-Ray NVO: Industry Group: Drug Manufacturers - General, Market Cap: 232.26B, Float: 3.37B Short Interest 0.70%, Days to Cover: 2.48, Exchange: NYSE

SOFI: Solid Beat on EPS ($0.08 vs est. $0.06), Strong Beat on Revs (44% YoY), Accelerating Rev Growth, 34% YoY Member Growth, Big Accelerations in KPIs, Raised Full Year Guide. Really excellent quarter, my only issue always with this stock is it can be a big fader, Huge float but has been in an uptrend for a while now and the daily setup is solid.

X-Ray SOFI: Industry Group: Credit Services, Market Cap: 23.23B, Float: 1.08B Short Interest 12.31%, Days to Cover: 1.97, Exchange: NASDAQ

Delayed Reaction Watchlists:

Market Awareness

Reduced my risk yesterday as per plan. Caught VWAV really nicely. Tomorrow is a massive day for the markets so i expect some choppiness today. Nothing speculator either way.

There are some nice earnings today and also some good looking Delayed Reactions. This morning’s gap up again gives me pause. Expect some fading and whipsaw action. Worth noting that tomorrow is the last day of the month also, which tends to see some rebalancing the day of and before. Cautious.

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk + Earnings Data (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply