- Stocks in Play

- Posts

- Stocks in Play - July 21st 2025

Stocks in Play - July 21st 2025

Stocks in Play: Stocks in Play: CLF, PMN, WRD & Delayed Reactions

Stocks in Play - July 21st 2025

Stocks in Play: CLF, PMN, WRD & Delayed Reactions

Welcome to today's Stocks in Play report. Below are the key stocks to watch, along with brief x-ray and analysis.

If you find this Newsletter helpful and ever want to say thank you then feel free to Buy Me a Coffee. It’ll inspire me to work faster….

I use Benzinga Pro (Essential) for 90% of my research each day. I have recently subscribed to a LIFETIME subscription for $1650. This is incredible value. If this is something you’d be interested in then shoot me an email ([email protected]) and I’ll put you in touch with the Rep to receive the agreed price. I couldn’t recommend it highly enough.

Honorable Mention to:

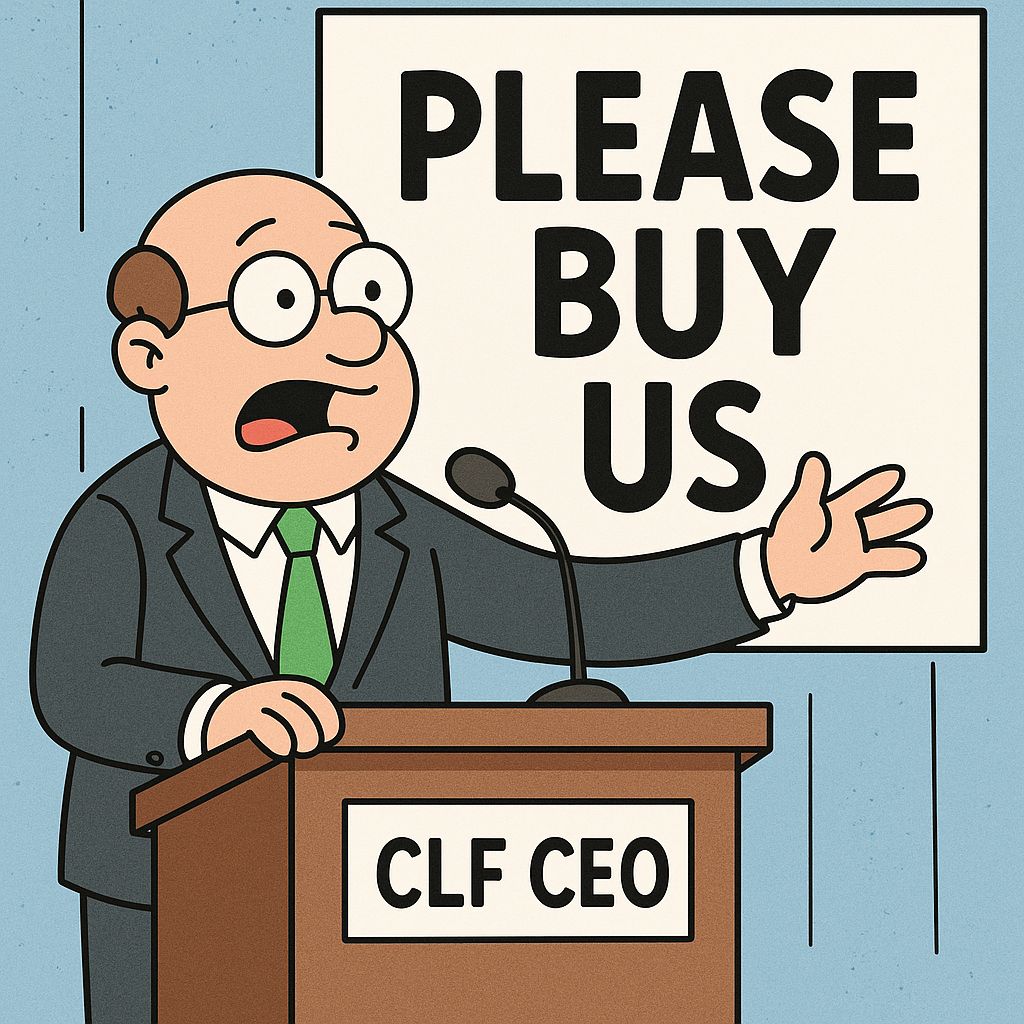

CLF : Solid Beat on EPS (-$0.50 vs est. -$0.79), Slight beat on Revs. CEO essentially called the company out as an Acquisition target due to Steel tariffs and their positioning as a US Based Steel company. Nice Daily Chart, coming off a Double bottom with Highest volume ever. Pretty good ADR% and right at the $10 number. Reasonable Short Interest also. I think this one can have a sustained run. Neglected. Tariff Theme.

X-Ray CLF: Industry Group: Steel, Market Cap: 4.69B, Float: 485.47M Short Interest 16.30%, Days to Cover: 2.51, Exchange: NYSE

PMN: ProMIS Neurosciences Granted Fast Track Designation by U.S. FDA for PMN310 in the Treatment of Alzheimer's Disease. Note it popped a week or so ago also when HC Wainright put a $4 target price on it. That move completely faded however. Penny stock. Legitimate Catalyst however could very easily do an equity raise during market hours.

X-Ray PMN: Industry Group: Biotechnology, Market Cap: 14.39M, Float: 23.12M Short Interest 0.61%, Days to Cover: 0.08, Exchange: NASDAQ

WRD: Launched the HPC 3.0 high-performance computing platform, jointly developed with Lenovo. the world's first mass-produced Level 4 (L4) autonomous vehicle built on NVIDIA DRIVE AGX Thor. Fully automotive-grade, HPC 3.0 reduces autonomous driving suite cost by 50%, paving the way for GXR's large-scale commercial deployment. In Theme - AVs. WRD has been an eternal Laggard stock but has a nice Base here and volume profile.

X-Ray WRD: Industry Group: Software - Application, Market Cap: 2.42B, Float: 259.44M Short Interest 3.51%, Days to Cover: 0.62, Exchange: NASDAQ

Delayed Reaction Watchlists:

Market Awareness

I’m like a broken record on a Monday. I rarely find that they are the best SIP days right out the gate. Start the week with a bit of caution. The Crypto Treasury theme pumps are fading pretty quickly. (or at least for now). I don’t see anything completely standout this morning however I do like several delayed reaction setups from my watchlists. (UAVS, NVTS, STEM, BZAI, ABVE - 30Min Consolidation for my style).

VIX Perky this morning, monitoring that closely today. Bullish overall.

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk + Earnings Data (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply