- Stocks in Play

- Posts

- Stocks in Play - April 30th 2025

Stocks in Play - April 30th 2025

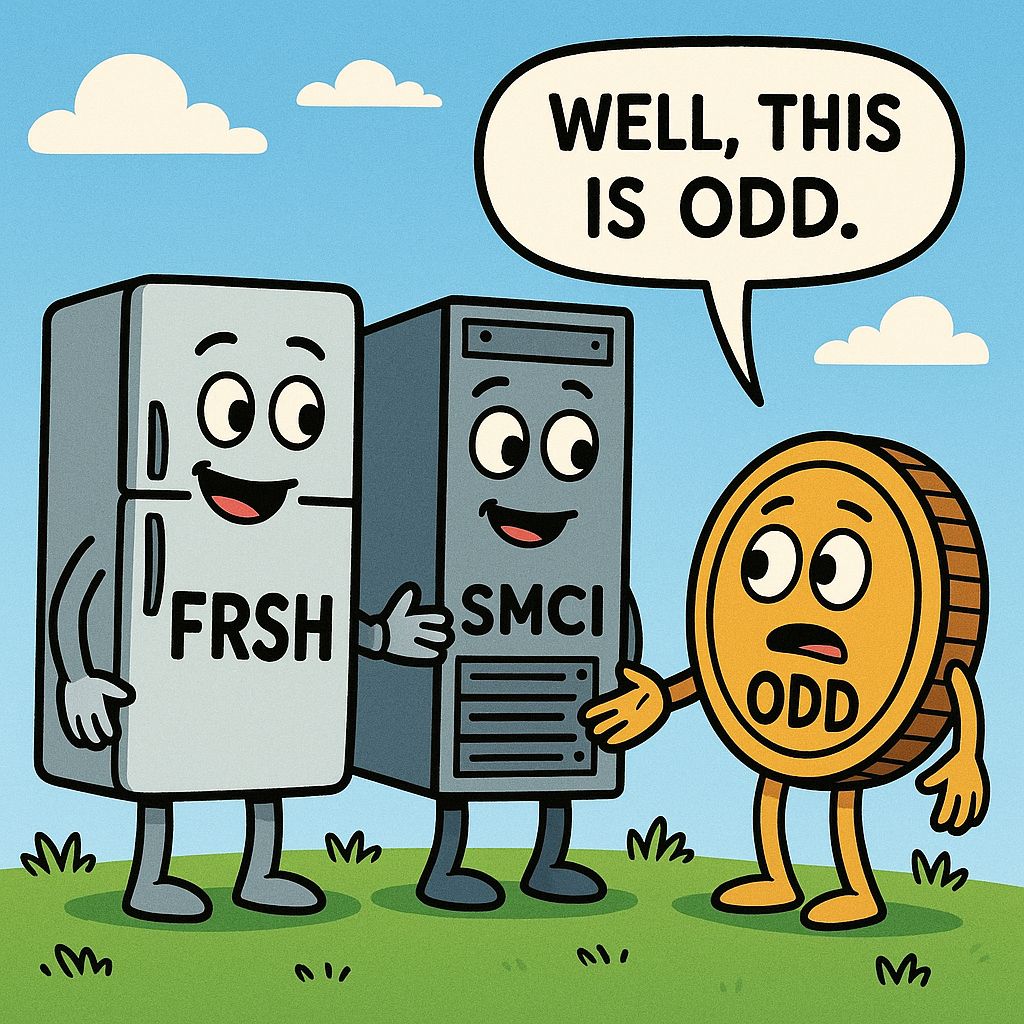

TLDR Stocks in Play: FRSH, ODD, JAKK, SOXS

Stocks in Play - April 30th 2025

TLDR Stocks in Play: FRSH, ODD, JAKK, SOXS

Welcome to today's Stocks in Play report. Below are the key stocks to watch, along with brief x-ray and analysis.

If you find this Newsletter helpful and ever want to say thank you then feel free to Buy Me a Coffee. It’ll inspire me to work faster….

1) Freshworks Inc (FRSH) (Rating: B-, Single-Day)

Industry Group: Packaged Software, Market Cap: $4.4b, Float: 180m, Short Interest: 4.5%, Days to Cover: 2.35, Exchange: NASDAQ

Catalyst: Strong Beat on EPS ($0.18 vs est $0.13), Solid Beat on Revs, Raised FY Guidance on Revs & EPS and positive management commentary on outlook. Feels like an outlier in AI for me today. Negative that it has ran into earnings.

2) Oddity Tech (ODD) (Rating: B+, Single-Day)

Industry Group: Technology Services, Market Cap: $2b, Float: 25.8m, Short Interest: 17.3%, Days to Cover: 9.6, Exchange: NASDAQ

Catalyst: Solid Beat on EPS ($0.69 vs est. $0.62) +63.7% YoY, Beat on Revs (+26.7% YoY), Raised full year Guidance on Revs and EPS above analyst estimates. This is an Israeli beauty company. As far as I’m aware it’s a bit scammy, or has had claims of being scammy. High Short Interest, Low Float & has been in a sideways range for a long time. Seems like a great SIP Candidate!

Honorable Mention to: JAKK - Small Cap that Licence Toys, IP and Merchandise. Strong Earnings, Large Beat on EPS, Strong Margins & Rev Growth. Positive management commentary. Very low float. This looks like a turnaround story to me. VERY illiquid so may be hard to trade.

SOXS - SMCI Preannounce of earnings is BAD and bad for the industry. We’ve rallied hard and this could pop the balloon. SOXS likely a solid play today.

Market Awareness

Note it’s the last trading day of the month which always tend to be a bit funky in my experience. Not as weird as end of quarter but you still see some strange volatility due to rebalancing. Earnings last night were relatively negative I thought. The Tariff line is being used more steadily now and none of it is good.

That being said the market is holding on and any selling day should be looked at as a shakeout until proven otherwise. We are gapping down this morning so again we look to see if it the market gets bought. Mega earnings tonight in MSFT, META & QCOM will weigh heavily on the market one way or the other.

I’m enjoying a day off today with some nice weather in Ireland so won’t be trading.

After Hours I’m Watching: META, MSFT, QCOM, HOOD, CFLT (Earnings)

Tomorrow Morning I’m Watching: RBLX, LLY, MA, CAH, CCJ (Earnings)

Top Pick Watchlists:

LONG: ALAB, HNST, SNOW, ESTC, RKLB, SMTC, URBN, PLTR, GAP, TSLA, SE, RDDT

LONG: CRDO, MRVL, OKTA, FIVE, RBRK, AVGO

LONG: CEG, FUBO, BLK, GE

LONG: MAT, PINS, AXON

LONG: SDGR, NFLX, GOOG,

Sources & Services I Use in my Trading:

Finviz - Short Interest, Float, Articles, Fundamentals (Free)

Benzinga Pro - News Source + News Squawk + Earnings Data (Paid)

Tradingview - Charting & Scanning (Paid)

Koyfin - Fundamental Data (Paid)

EarningsWhispers - Earnings Calendar (Free)

Tradersync - Trade Journal (Paid)

PS: There are many ways to trade stocks in play. It does not have to be the one that keeps going straight up and sometimes it doesn’t even have to be day one of the catalyst. Everyone must find a setup, timeframe and method that works for them. This list is supposed to educate on the criteria I use and the methods in which I find Stocks in Play. Yours may differ and that is completely okay.

Reply