- Stocks in Play

- Posts

- Stocks in Play - 5th February 2026

Stocks in Play - 5th February 2026

Today in Focus: Reduced Activity

Stocks in Play - 5th February 2026

Today in Focus: Reduced Activity

Sources & Services I Use in my Trading:

Finviz - Scanning, Short Interest, Float, Fundamentals

Benzinga Pro - News + Squawk

Tradingview - Charting & Scanning

BiopharmaIQ - FDA Calendars & Upcoming Biotech Catalysts

Koyfin - Fundamental Data

Tradersync - Trade Journal

Situational Awareness

Market Condition: VIX Rising, Crypto Selling Off, Indexes Weak. GOOG Green to Red last night.

Commentary: Reduced activity for me today. I think that even solid earnings candidates have low probability of follow through. I would be very careful here for new positions in either direction.

Upcoming Earnings:

After Hours: AMZN, ARWR, BARK, IREN, BE

Before Open: BIIB NVT

Trade Updates:

New: NVO (Short), INNV

Current Positions: NVO (Short), INNV, GLW, MPC

Sells: DECK (Closed), PYPL (Closed)

INNV very small size due to being illiquid. Didn’t include it on Newsletter for this reason. Position just as part of process of following A+ chart. PYPL closed due to strength at $40 and a wariness that some M&A may come in. Will continue to watch for delayed reaction.

Reduced Activity

Current market conditions don't present quality setups that meet my criteria. Rather than force picks, I'm staying disciplined and monitoring for better opportunities.

Watching:

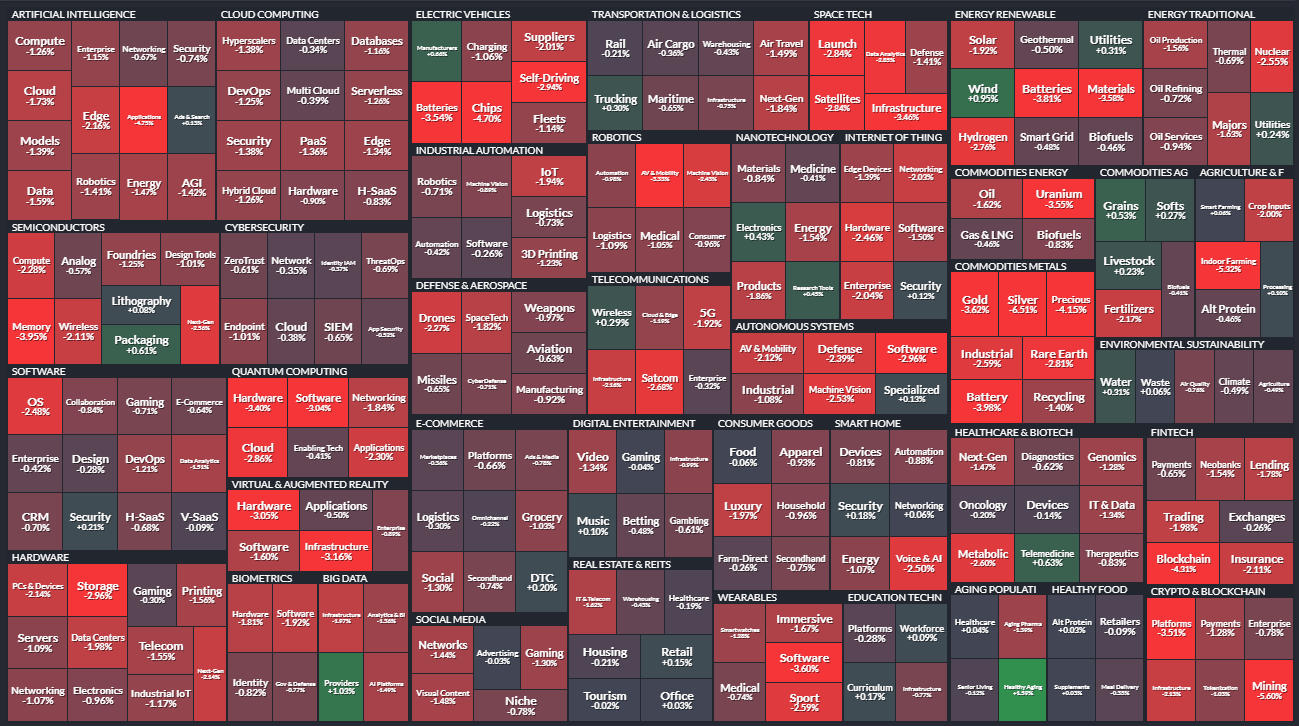

Oil and Gas: Strong theme that I will look to do some work on today.

Oversold Bounces: Watching to see what areas bounce today if the selling dissipates later in the day.

Using Finviz Map below as a guide today.

Quality setups only. Better to sit tight.

Like what you're reading? Support this work via ☕ Ko-Fi.

Note: This is my methodology for identifying stocks in play. There are many valid approaches to trading catalysts—find the setups, timeframes, and risk parameters that align with your strategy.

Reply